North America : Market Leader in MRO Services

North America is poised to maintain its leadership in the Mining Fleet Management System MRO Services Market, holding a market size of $1.75 billion. Key growth drivers include advanced technology adoption, stringent safety regulations, and increasing demand for operational efficiency. The region's robust mining sector, coupled with government initiatives promoting sustainable practices, further fuels market expansion.

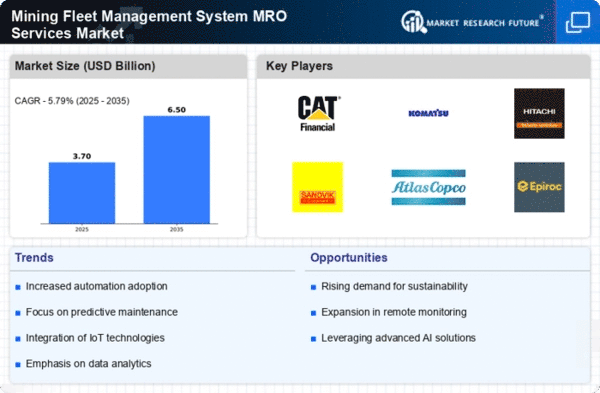

The United States and Canada are the leading countries in this sector, with major players like Caterpillar, Trimble, and Wenco International Mining Systems driving innovation. The competitive landscape is characterized by strategic partnerships and technological advancements, ensuring that North America remains at the forefront of MRO services in mining.

Europe : Emerging Market with Growth Potential

Europe's Mining Fleet Management System MRO Services Market is valued at $1.0 billion, driven by increasing investments in mining infrastructure and a shift towards automation. Regulatory frameworks emphasizing environmental sustainability and safety standards are pivotal in shaping market dynamics. The region's focus on reducing carbon emissions and enhancing operational efficiency is expected to propel growth in the coming years.

Leading countries such as Germany, Sweden, and Finland are at the forefront of this market, with key players like Sandvik and Epiroc contributing significantly. The competitive landscape is marked by innovation and collaboration among industry leaders, ensuring that Europe remains a vital player in The Mining Fleet Management System MRO Services. "The European mining sector is committed to sustainable practices, which will drive technological advancements in fleet management systems."

Asia-Pacific : Rapidly Growing Market Dynamics

The Asia-Pacific region, with a market size of $0.9 billion, is witnessing rapid growth in the Mining Fleet Management System MRO Services Market. Key drivers include increasing mineral exploration activities, rising demand for automation, and government initiatives aimed at enhancing mining efficiency. Countries like Australia and China are leading the charge, supported by favorable regulations and investments in technology.

Australia stands out as a major player, with companies like Komatsu and Hitachi Construction Machinery leading the market. The competitive landscape is characterized by a mix of local and international players, all vying for a share of this burgeoning market. As the region continues to invest in mining infrastructure, the demand for advanced MRO services is expected to rise significantly.

Middle East and Africa : Emerging Opportunities in Mining

The Middle East and Africa region, with a market size of $0.75 billion, is gradually emerging as a significant player in the Mining Fleet Management System MRO Services Market. The growth is driven by increasing mining activities, particularly in countries like South Africa and the UAE, where there is a push for modernization and efficiency. Regulatory support for mining operations is also a catalyst for market expansion.

South Africa is a key player in this region, with a focus on enhancing operational efficiency and sustainability. The competitive landscape includes both local and international firms, with companies like Atlas Copco and Hexagon making notable contributions. As the region continues to develop its mining capabilities, the demand for MRO services is expected to grow. "The mining sector in Africa is poised for growth, driven by modernization and regulatory support for sustainable practices."