North America : Market Leader in Fleet Services

North America holds a commanding 45.5% share of the Fleet Vehicle Maintenance and Repair Services Market, driven by a robust logistics sector and increasing demand for fleet optimization. Regulatory support for emissions standards and safety regulations further catalyzes market growth. The region's focus on technological advancements, such as telematics and predictive maintenance, enhances service efficiency and reduces operational costs.

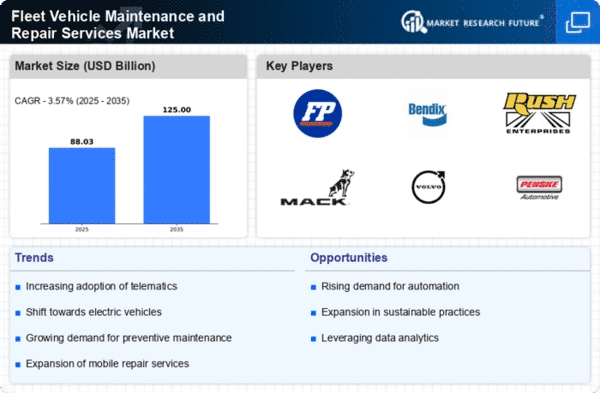

The competitive landscape is characterized by major players like FleetPride, Rush Enterprises, and Penske Automotive Group, which dominate the market with extensive service networks. The U.S. leads in fleet size and maintenance spending, while Canada and Mexico are also emerging markets. The presence of established companies ensures a high level of service quality and innovation, making North America a pivotal region in The Fleet Vehicle Maintenance and Repair Services.

Europe : Growing Demand for Fleet Services

Europe accounts for a significant 25.0% of the Fleet Vehicle Maintenance and Repair Services Market, driven by stringent environmental regulations and a growing emphasis on sustainability. The European Union's Green Deal and various national initiatives promote the adoption of electric and hybrid vehicles, which in turn increases the demand for specialized maintenance services. This regulatory environment is a key driver for market growth across the region.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with a competitive landscape featuring key players like Volvo Trucks and local service providers. The presence of advanced technology in fleet management and maintenance services enhances operational efficiency. As the market evolves, companies are increasingly focusing on digital solutions to streamline operations and improve customer service, positioning Europe as a dynamic player in the fleet services sector.

Asia-Pacific : Emerging Market Potential

Asia-Pacific represents a growing segment of the Fleet Vehicle Maintenance and Repair Services Market, with a share of 10.0%. The region's rapid urbanization and increasing logistics activities are key growth drivers. Countries like China and India are witnessing a surge in fleet operations, leading to heightened demand for maintenance services. Government initiatives aimed at improving transportation infrastructure further support market expansion.

China is the largest market in the region, with significant investments in fleet management technologies. The competitive landscape includes both local and international players, with companies focusing on enhancing service offerings through technology integration. As the region continues to develop, the demand for efficient fleet maintenance solutions is expected to rise, making Asia-Pacific a vital area for future growth in this sector.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa hold a modest 4.5% share of the Fleet Vehicle Maintenance and Repair Services Market, but the region is ripe with untapped opportunities. Economic diversification efforts in countries like the UAE and South Africa are driving investments in logistics and transportation, which in turn boosts demand for fleet maintenance services. Regulatory frameworks are gradually evolving to support this growth, focusing on safety and environmental standards.

Key players in the region are beginning to establish a foothold, with local companies and international firms exploring partnerships to enhance service delivery. The competitive landscape is still developing, but as infrastructure improves and fleet operations expand, the Middle East and Africa are poised for significant growth in the fleet services market, attracting both investment and innovation.