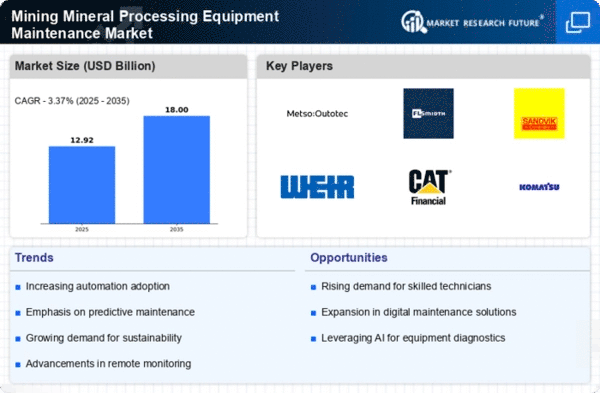

The Mining Mineral Processing Equipment Maintenance Market is characterized by a dynamic competitive landscape, driven by technological advancements, increasing demand for efficient operations, and a growing emphasis on sustainability. Key players such as Metso Outotec (FI), FLSmidth (DK), and Caterpillar (US) are strategically positioned to leverage innovation and digital transformation to enhance their service offerings. Metso Outotec (FI) focuses on integrating digital solutions into maintenance services, while FLSmidth (DK) emphasizes sustainability through its eco-friendly equipment maintenance practices. Caterpillar (US) is enhancing its operational efficiency through strategic partnerships, collectively shaping a competitive environment that prioritizes technological integration and sustainable practices.The market structure appears moderately fragmented, with several players competing for market share through localized manufacturing and optimized supply chains. Companies are increasingly localizing their operations to reduce lead times and enhance service delivery. This strategy not only improves customer satisfaction but also allows for better responsiveness to regional market demands. The collective influence of key players fosters a competitive atmosphere where innovation and operational efficiency are paramount.

In November Metso Outotec (FI) announced the launch of its new predictive maintenance software, designed to enhance equipment reliability and reduce downtime. This strategic move underscores the company's commitment to digital transformation and positions it as a leader in the integration of advanced technologies in maintenance services. The predictive capabilities of this software are expected to significantly improve operational efficiency for clients, thereby reinforcing Metso Outotec's competitive edge.

In October FLSmidth (DK) entered into a partnership with a leading technology firm to develop AI-driven maintenance solutions. This collaboration aims to harness artificial intelligence to optimize maintenance schedules and reduce operational costs for mining companies. The strategic importance of this partnership lies in its potential to revolutionize maintenance practices, making them more proactive rather than reactive, which could lead to substantial cost savings and improved equipment performance.

In September Caterpillar (US) expanded its service offerings by acquiring a regional maintenance service provider. This acquisition is likely to enhance Caterpillar's market presence and service capabilities in key mining regions. By integrating local expertise with its global resources, Caterpillar aims to provide tailored maintenance solutions that meet the specific needs of its clients, thereby strengthening its competitive position in the market.

As of December current trends in the Mining Mineral Processing Equipment Maintenance Market indicate a strong shift towards digitalization, sustainability, and AI integration. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to pool resources and expertise to drive innovation. The evolution of competitive differentiation appears to be moving away from price-based competition towards a focus on technological advancements, reliability in supply chains, and sustainable practices. This shift suggests that companies that prioritize innovation and customer-centric solutions are likely to thrive in the evolving market.