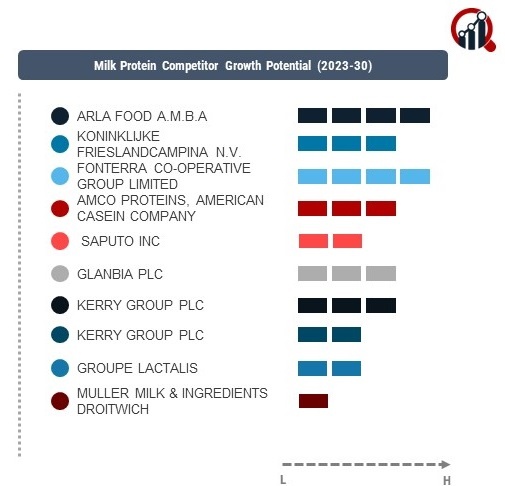

Top Industry Leaders in the Milk Protein Market

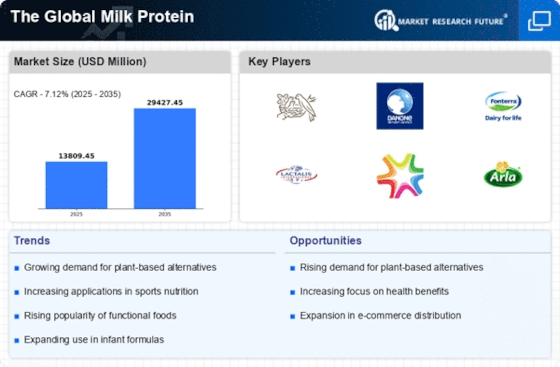

The milk protein market is characterized by a competitive landscape where key players strive to establish dominance and cater to the increasing demand for high-quality protein products.

Notable players in this market include

- Arla Foods Amba

- Royal Friesland Campina N.V.

- Fonterra Co-Operative Group Limited

- AMCO Proteins

- Saputo Inc.

- Glanbia plc

- Kerry Group plc

- Havero Hoogwegt Group

- Groupe Lactalis

Strategies Adopted:

To strengthen their market positions, companies in the milk protein sector have adopted various strategies. Product innovation and development have been paramount, with an emphasis on creating value-added milk protein products that align with consumer preferences for functional and nutritious offerings. Strategic partnerships and collaborations have also been a common approach, allowing companies to leverage each other's strengths, share resources, and expand their market reach. Additionally, mergers and acquisitions have played a significant role, enabling key players to diversify their product offerings and enhance their competitive advantage.

Market share analysis in the milk protein industry is influenced by several factors. Brand reputation and customer loyalty are crucial elements, with consumers often choosing products from well-established and trusted brands. Quality and nutritional content of the milk protein products, pricing strategies, and effective marketing efforts are also key determinants of market share. Furthermore, distribution networks and partnerships with retailers contribute to the accessibility of products, influencing consumer choices and, subsequently, market share.

As the milk protein market evolves, new and emerging companies are making their mark by introducing innovative products and technologies. These companies often focus on niche segments or unique formulations, challenging established players and contributing to the overall diversification of the market. Some noteworthy entrants include NutraDairy, specializing in organic and grass-fed milk protein, and ProHealthProtein, a startup emphasizing plant-based milk protein alternatives. These emerging players bring agility and fresh perspectives to the market, driving innovation and responding to evolving consumer preferences.

Industry news and current investment trends in the milk protein sector reflect the dynamic nature of the market. Companies are increasingly investing in research and development to stay ahead of consumer trends and differentiate their products. This includes the exploration of new processing technologies to enhance the functional properties of milk proteins and improve their applications in various food and beverage products. Moreover, investments in sustainable and ethical sourcing practices are gaining traction, aligning with the growing demand for responsibly produced food ingredients.

Competitive Scenario:

In the overall competitive scenario, key players are not only focused on product innovation but also on adapting to broader market trends. The increasing consumer awareness of health and wellness has prompted companies to emphasize the nutritional benefits of milk proteins, positioning them as essential components in a balanced diet. Companies are also investing in marketing strategies that highlight the versatility of milk proteins, appealing to a wide range of consumer demographics.

Recent Development

A significant recent development in 2023 within the milk protein market has been the heightened emphasis on sustainability. Major players in the industry have intensified efforts to reduce their environmental footprint by adopting sustainable sourcing practices and implementing eco-friendly manufacturing processes. Additionally, there has been a notable shift towards eco-conscious packaging solutions to address growing consumer concerns about plastic waste. This development underscores the industry's commitment to environmental responsibility and reflects a broader trend towards sustainable practices in the food and beverage sector.