Government Support for Dairy Sector

The Brazilian government plays a crucial role in supporting the dairy sector, which directly impacts the milk protein market. Initiatives aimed at improving dairy farming practices and enhancing product quality are currently being implemented. Recent policies have included financial incentives for dairy farmers to adopt sustainable practices, which may lead to increased milk production and, consequently, a larger supply of milk protein. The government's focus on boosting the dairy industry is expected to foster innovation and competitiveness within the milk protein market. As these initiatives take effect, the market may experience growth in both domestic consumption and export opportunities, further solidifying Brazil's position in the global dairy landscape.

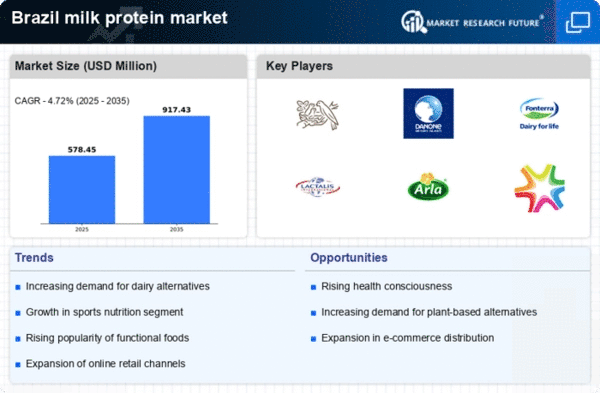

Rising Popularity of Functional Foods

The milk protein market in Brazil is experiencing a shift towards functional foods, which are perceived to offer health benefits beyond basic nutrition. This trend is driven by consumers seeking products that support specific health goals, such as weight management and muscle recovery. The functional food segment is projected to grow at a rate of 10% annually, indicating a robust market opportunity for milk protein products. As manufacturers innovate to create functional dairy items, the milk protein market is likely to see an influx of products enriched with vitamins, minerals, and probiotics. This evolution aligns with the increasing consumer preference for foods that contribute to overall well-being, thereby enhancing the market's growth potential.

Expansion of Dairy Processing Facilities

The milk protein market in Brazil is likely to benefit from the expansion of dairy processing facilities across the country. Investments in modernizing and increasing the capacity of these facilities are expected to enhance the production of milk protein products. Recent data indicates that Brazil's dairy processing sector has seen an investment increase of around 15% over the past two years. This expansion not only improves the efficiency of production but also allows for the introduction of innovative milk protein products that cater to diverse consumer preferences. As processing capabilities grow, the milk protein market may witness a broader range of offerings, appealing to both health-conscious consumers and those seeking functional food ingredients.

Increasing Demand for Nutritional Products

The milk protein market in Brazil experiences a notable surge in demand for nutritional products, driven by a growing awareness of health and wellness among consumers. This trend is reflected in the increasing consumption of protein-rich foods, with a reported growth rate of approximately 8% annually. As consumers prioritize high-quality protein sources, the milk protein market is well-positioned to benefit from this shift. The rise in fitness culture and the popularity of protein supplements further contribute to this demand, as individuals seek to enhance their dietary intake. Additionally, the Brazilian government has been promoting nutritional education, which may lead to an even greater emphasis on protein consumption in the coming years.

Consumer Shift Towards Plant-Based Alternatives

While the milk protein market in Brazil is traditionally dominated by animal-based products, there is a noticeable shift towards plant-based alternatives. This trend is driven by a segment of consumers who are increasingly adopting vegetarian and vegan diets, seeking protein sources that align with their lifestyle choices. The plant-based protein market is projected to grow by approximately 12% annually, indicating a potential challenge for the milk protein market. However, this shift also presents opportunities for innovation, as dairy producers may explore hybrid products that combine milk protein with plant-based ingredients. By adapting to these changing consumer preferences, the milk protein market can potentially expand its reach and appeal to a broader audience.