Increased Defense Spending

Technological Advancements

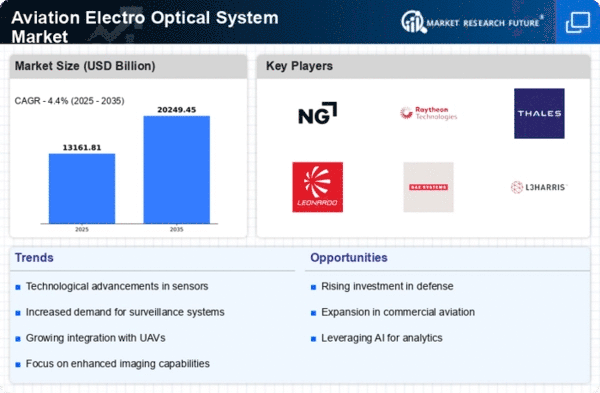

The Global aviation electro optical system Market Industry is experiencing rapid technological advancements, particularly in sensor technology and data processing capabilities. Innovations such as high-resolution infrared cameras and advanced image processing algorithms enhance situational awareness and target identification. These advancements are crucial for military and commercial applications, where precision and reliability are paramount. For instance, the integration of artificial intelligence in electro-optical systems allows for real-time data analysis, improving decision-making processes. As a result, the market is projected to reach 12607.1 USD Billion in 2024, reflecting the growing demand for sophisticated systems that can operate in diverse environments.

Regulatory Support and Standardization

Regulatory support and standardization play a crucial role in shaping the Global Aviation Electro Optical System Market Industry. Governments and international organizations are increasingly establishing guidelines and standards to ensure the safety and effectiveness of electro-optical systems. This regulatory framework fosters innovation and encourages manufacturers to develop compliant products that meet stringent requirements. For instance, the Federal Aviation Administration (FAA) in the United States has implemented regulations that promote the use of advanced electro-optical systems in aviation. Such support not only enhances market growth but also ensures that systems are reliable and effective in various operational contexts.

Growing Demand for Unmanned Aerial Vehicles

The rising demand for unmanned aerial vehicles (UAVs) is a significant driver of the Global Aviation Electro Optical System Market Industry. UAVs are increasingly utilized for various applications, including surveillance, reconnaissance, and disaster management. The integration of electro-optical systems in UAVs enhances their operational capabilities, enabling real-time data collection and analysis. As military and civilian sectors recognize the advantages of UAVs, the market is likely to witness substantial growth. The anticipated compound annual growth rate of -43.08% for 2025-2035 suggests a shift in focus towards more advanced systems, indicating a potential market evolution driven by technological advancements and changing operational needs.

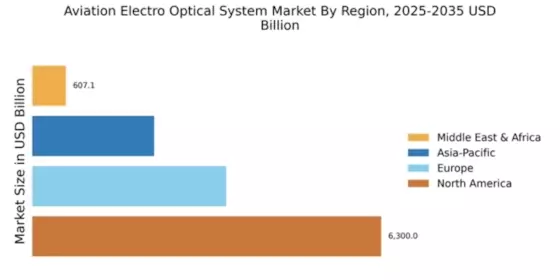

Market Diversification and Global Expansion

Market diversification and global expansion are pivotal factors influencing the Global Aviation Electro Optical System Market Industry. Companies are increasingly exploring new markets and applications, driven by the need to adapt to changing customer demands and technological advancements. This trend is evident as manufacturers expand their product offerings to include systems suitable for both military and civilian applications. Additionally, partnerships and collaborations with international firms facilitate knowledge transfer and access to new markets. As a result, the market is likely to witness a dynamic evolution, with companies striving to capture a larger share of the growing demand for advanced electro-optical systems.