Military Electro Optical Infrared Systems Size

Market Size Snapshot

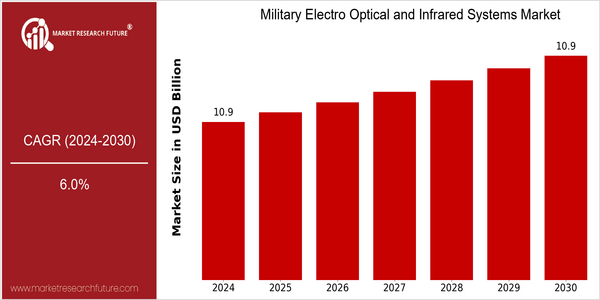

| Year | Value |

|---|---|

| 2024 | USD 10.86 Billion |

| 2030 | USD 10.86 Billion |

| CAGR (2023-2030) | 6.0 % |

Note – Market size depicts the revenue generated over the financial year

The Military Electro Optical and Infrared Systems market is poised for steady growth, with a current market size of USD 10.86 billion in 2024, projected to maintain the same valuation through 2030. This stability, coupled with a compound annual growth rate (CAGR) of 6.0% from 2023 to 2030, indicates a robust demand for advanced military technologies. The market's growth trajectory is primarily driven by increasing defense budgets across various nations, the rising need for enhanced surveillance and reconnaissance capabilities, and the integration of cutting-edge technologies such as artificial intelligence and machine learning into electro-optical and infrared systems.

Key players in this sector, including Lockheed Martin, Northrop Grumman, and Raytheon Technologies, are actively investing in research and development to innovate and enhance their product offerings. Strategic initiatives such as partnerships with technology firms, investments in next-generation sensor technologies, and the launch of advanced systems tailored for modern warfare are pivotal in shaping the competitive landscape. As military operations become increasingly reliant on sophisticated imaging and targeting systems, the demand for electro-optical and infrared solutions is expected to remain strong, ensuring sustained market growth in the coming years.

Regional Market Size

Regional Deep Dive

The Military Electro Optical and Infrared Systems Market is characterized by rapid technological advancements and increasing defense budgets across various regions. In North America, particularly the United States, there is a strong emphasis on modernization and integration of advanced systems into military operations. Europe is witnessing a surge in collaborative defense initiatives, while Asia-Pacific is experiencing significant investments in indigenous defense capabilities. The Middle East and Africa are focusing on enhancing surveillance and reconnaissance capabilities, driven by regional security challenges. Latin America, though smaller in scale, is gradually increasing its defense spending, particularly in border security and anti-drug operations, which is fostering growth in the market.

Europe

- The European Union's Permanent Structured Cooperation (PESCO) initiative is fostering collaboration among member states to develop advanced military technologies, including electro-optical systems, enhancing interoperability.

- Companies like Thales Group and Leonardo are leading the charge in developing innovative infrared systems, with a focus on integrating AI and machine learning for improved data analysis and decision-making.

Asia Pacific

- Countries like India and Japan are ramping up their defense budgets and focusing on indigenous production of electro-optical systems, driven by the need for self-reliance in defense capabilities.

- The rise of regional tensions has led to increased procurement of advanced surveillance systems, with companies like Mitsubishi Electric and Bharat Electronics Limited playing pivotal roles in this development.

Latin America

- Countries like Brazil and Colombia are increasingly focusing on enhancing their military capabilities, particularly in border security, which is driving demand for electro-optical surveillance systems.

- The Brazilian Army has initiated projects to upgrade its reconnaissance capabilities, collaborating with local firms to develop cost-effective electro-optical solutions.

North America

- The U.S. Department of Defense has recently increased funding for advanced electro-optical systems, emphasizing the need for enhanced situational awareness and targeting capabilities in military operations.

- Key players like Raytheon Technologies and Northrop Grumman are investing heavily in R&D for next-generation infrared sensors, which are expected to improve detection ranges and operational effectiveness.

Middle East And Africa

- The Gulf Cooperation Council (GCC) countries are investing heavily in modernizing their military capabilities, with a particular focus on advanced electro-optical systems for border security and counter-terrorism operations.

- Local firms, such as EDGE Group in the UAE, are emerging as key players in the development of advanced infrared technologies tailored to regional security needs.

Did You Know?

“Did you know that infrared systems can detect heat signatures from objects, allowing military forces to see in complete darkness and through smoke or fog?” — Military Technology Journal

Segmental Market Size

The Military Electro Optical and Infrared Systems segment plays a crucial role in enhancing situational awareness and targeting capabilities for defense forces, and it is currently experiencing robust growth. Key drivers of demand include the increasing need for advanced surveillance systems to counter evolving threats and the integration of artificial intelligence in military operations, which enhances data processing and decision-making. Additionally, regulatory policies emphasizing modernization of defense technologies further stimulate investment in these systems.

Currently, the adoption stage of these systems is in the scaled deployment phase, with notable examples including the U.S. Department of Defense's investment in advanced infrared sensors and the European Union's initiatives to enhance border security through electro-optical systems. Primary applications encompass reconnaissance, surveillance, and target acquisition, with companies like Raytheon and Northrop Grumman leading in innovative solutions. Trends such as geopolitical tensions and the push for enhanced military capabilities are accelerating growth, while technologies like machine learning and advanced imaging techniques are shaping the segment's evolution.

Future Outlook

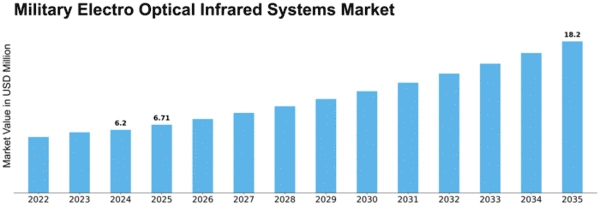

The Military Electro Optical and Infrared Systems Market is poised for steady growth from 2024 to 2030, with a projected compound annual growth rate (CAGR) of 6.0%. By 2030, the market value is expected to reach approximately $10.86 billion, reflecting a robust demand for advanced surveillance and targeting systems. This growth trajectory is driven by increasing defense budgets across various nations, particularly in response to rising geopolitical tensions and the need for enhanced situational awareness on the battlefield. As military forces modernize their capabilities, the integration of electro-optical and infrared systems into existing platforms will become increasingly prevalent, leading to higher penetration rates in both land and aerial applications.

Key technological advancements, such as the development of high-resolution sensors, improved image processing algorithms, and miniaturization of components, are expected to further propel market growth. Additionally, the adoption of artificial intelligence (AI) and machine learning (ML) in data analysis and target recognition will enhance the operational effectiveness of these systems. Emerging trends, including the shift towards unmanned systems and the increasing use of dual-use technologies, will also shape the market landscape. As military organizations prioritize interoperability and network-centric warfare capabilities, the demand for integrated electro-optical and infrared solutions will continue to rise, solidifying the market's position as a critical component of modern defense strategies.

Leave a Comment