Military Airborne Radar Market Summary

As per MRFR analysis, the Military Airborne Radar Market Size was estimated at 2687.78 USD Million in 2024. The Military Airborne Radar industry is projected to grow from 2854.96 USD Million in 2025 to 5220.03 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 6.22% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Military Airborne Radar Market is poised for substantial growth driven by technological advancements and increased defense spending.

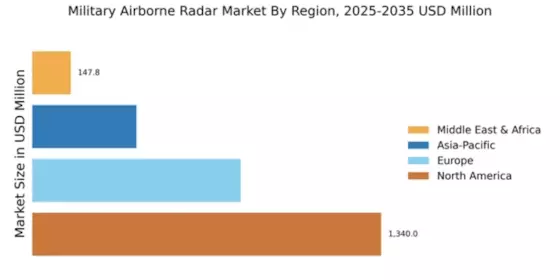

- North America remains the largest market for military airborne radar, driven by robust defense budgets and advanced technological capabilities.

- The Asia-Pacific region is emerging as the fastest-growing market, reflecting heightened geopolitical tensions and a focus on modernization.

- Surveillance radar systems dominate the market, while targeting radar systems are experiencing the fastest growth due to evolving military strategies.

- Key market drivers include technological advancements in radar systems and rising demand for surveillance and reconnaissance capabilities.

Market Size & Forecast

| 2024 Market Size | 2687.78 (USD Million) |

| 2035 Market Size | 5220.03 (USD Million) |

| CAGR (2025 - 2035) | 6.22% |

Major Players

Northrop Grumman (US), Raytheon Technologies (US), Lockheed Martin (US), Thales Group (FR), BAE Systems (GB), Leonardo (IT), Hensoldt (DE), Elbit Systems (IL), Saab (SE)