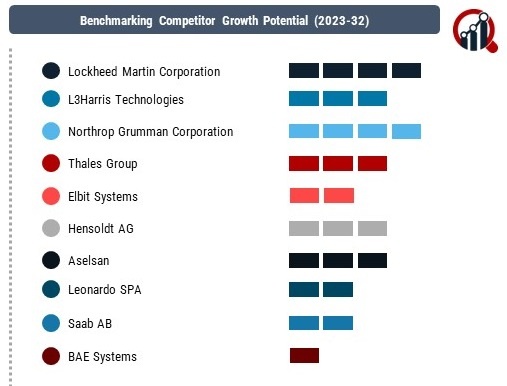

Top Industry Leaders in the Military Airborne Radar Market

Key Companies in the military airborne radar market include

Lockheed Martin Corporation (US)

L3Harris Technologies (US)

Northrop Grumman Corporation (US)

Thales Group (France)

Elbit Systems (Israel)

Hensoldt AG (Germany)

Aselsan (Turkey)

Leonardo SPA (Italy)

Saab AB (Sweden)

BAE Systems (UK)

Israel Aerospace Industries (Israel)

Strategies Adopted

Industry news within the Military Airborne Radar Market often highlights successful radar system deployments, collaborations between defense contractors and military organizations, and advancements in radar technology. Companies regularly announce new contracts, upgrades to existing radar systems, and participation in defense exhibitions to showcase the capabilities and reliability of their radar solutions. Regulatory updates related to military radar standards, advancements in electronic warfare, and international collaborations in defense technology also impact the competitive dynamics of the market, prompting companies to align their offerings with evolving requirements.

Current trends in company investments within the Military Airborne Radar Market reflect a notable focus on electronic warfare capabilities, integration with other avionics systems, and the development of radar systems for unmanned aerial vehicles (UAVs). Companies allocate resources to enhance radar capabilities to counter emerging threats, improve interoperability with other onboard systems, and cater to the growing demand for radar systems in UAV applications. Strategic partnerships, participation in industry forums, and collaboration with defense agencies are common trends among key players to stay abreast of technological advancements and maintain competitiveness.

Emerging Companies

The overall competitive scenario in the Military Airborne Radar Market remains dynamic, with companies navigating evolving military requirements, technological advancements, and geopolitical considerations. Established players face the challenge of continuously innovating to meet the changing demands of defense agencies and ensure their radar solutions remain at the forefront of technology. The competition is expected to intensify as emerging companies secure contracts, introducing novel radar technologies and challenging the market share of established airborne radar system providers. In this environment, adaptability, responsiveness to defense requirements, and a commitment to technological excellence will be crucial for companies to maintain and enhance their competitive positions in the Military Airborne Radar Market.

Recent News

Won a $300 million contract from the U.S. Air Force to upgrade the APG-85 active electronically scanned array radar on F-16 fighter jets, significantly improving their air-to-air and air-to-ground targeting capabilities.

Developed the L350G AESA radar, featuring extended detection range and enhanced resolution for maritime patrol aircraft, strengthening coastal security and surveillance capabilities for various countries.

Investing in research on GaN-based AESA radars, offering improved power efficiency and performance compared to current silicon-based systems, paving the way for future generations of military airborne radar technology.

Delivered the RBE2-AA AESA radar for the Rafale fighter jet, providing pilots with exceptional situational awareness and long-range detection capabilities against advanced aerial threats.

Developed the Ground Master 400 AESA radar for air defense applications, offering long-range detection and tracking of aircraft, drones, and ballistic missiles, strengthening national airspace security.

Partnering with Leonardo DRS to develop a new tactical multi-role radar for light attack aircraft, providing enhanced battlefield surveillance and targeting capabilities for close air support missions.

Secured a $350 million contract from the U.S. Navy to supply its SPY-7 active electronically scanned array radar for the Ford-class aircraft carriers, ensuring superior detection and tracking of aerial and surface threats.

Developed the Sea Dragon radar for maritime patrol aircraft, offering comprehensive surface and subsurface scanning capabilities for anti-submarine warfare and maritime search and rescue operations.

Focused on miniaturization and integration technologies for airborne radar systems, aiming to equip smaller unmanned aerial vehicles (UAVs) with advanced radar capabilities for reconnaissance and surveillance missions.

Delivering the Erieye Extended Range AESA radar for airborne early warning and control aircraft, providing long-range detection and tracking capabilities for air force and coast guard operations.

Developed the Giraffe Agile Multibeam Radar for ground and naval applications, offering 360-degree situational awareness and threat detection against airborne and surface targets.

Partnering with other European defense companies to develop a next-generation AESA radar for fighter jets, aiming to increase European collaboration and technological leadership in the military airborne radar market.