Increased Defense Budgets

The military aerospace-sensors market is experiencing a notable boost due to increased defense budgets across various branches of the U.S. military. In recent years, the U.S. government has allocated substantial funds to enhance national security, with a projected budget of approximately $750 billion for defense in 2025. This financial commitment is likely to drive demand for advanced sensors that improve situational awareness and operational efficiency. As military operations become more complex, the need for sophisticated sensor technologies, including radar, electro-optical, and infrared systems, is paramount. Consequently, the military aerospace-sensors market is poised for growth as defense contractors seek to develop and integrate cutting-edge sensor solutions to meet the evolving requirements of the armed forces.

Focus on Modernization and Upgrades

The military aerospace-sensors market is significantly influenced by the ongoing focus on modernization and upgrades of existing military platforms. The U.S. military recognizes the necessity of maintaining technological superiority, leading to substantial investments in upgrading sensor systems across various aircraft and ground vehicles. This trend is evident in programs aimed at retrofitting older platforms with state-of-the-art sensors to enhance their operational capabilities. The market is expected to see a surge in demand for sensor upgrades, with estimates suggesting that modernization efforts could account for over 30% of total military spending in the coming years. As a result, the military aerospace-sensors market is likely to benefit from these initiatives, fostering innovation and enhancing the effectiveness of military operations.

Growing Demand for ISR Capabilities

The military aerospace-sensors market is witnessing a growing demand for Intelligence, Surveillance, and Reconnaissance (ISR) capabilities. The U.S. military emphasizes the need for real-time data to support strategic decision-making and operational effectiveness. As conflicts become more dynamic, the ability to gather and analyze information swiftly is crucial. The market for ISR-related sensors is projected to reach approximately $20 billion by 2026, reflecting a robust growth trajectory. This demand is driven by the increasing reliance on unmanned aerial vehicles (UAVs) and other platforms equipped with advanced sensors. Consequently, the military aerospace-sensors market is expected to expand as defense agencies invest in ISR technologies to enhance situational awareness and operational readiness.

Increased Collaboration with Private Sector

The military aerospace-sensors market is experiencing increased collaboration between the U.S. military and private sector companies. This partnership aims to leverage cutting-edge technologies and innovative solutions to enhance military capabilities. The U.S. Department of Defense has initiated various programs to foster collaboration, including the Defense Innovation Unit, which seeks to accelerate the adoption of commercial technologies. This trend is likely to drive the development of advanced sensor systems that meet the specific needs of military operations. As private companies invest in research and development, the military aerospace-sensors market may witness a surge in innovative sensor technologies, ultimately improving the effectiveness and efficiency of military operations.

Technological Advancements in Sensor Capabilities

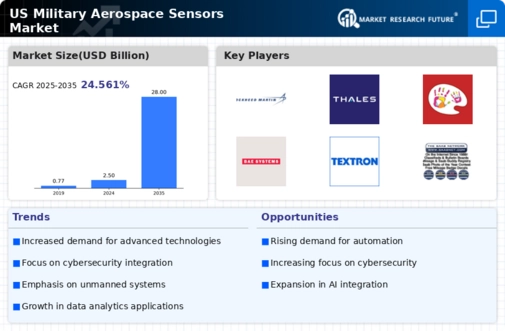

Technological advancements are significantly shaping the military aerospace-sensors market. Innovations in materials science, data processing, and miniaturization are enabling the development of more efficient and effective sensors. For instance, the integration of artificial intelligence (AI) and machine learning algorithms into sensor systems enhances data analysis and decision-making processes. The market is projected to grow at a CAGR of around 5% from 2025 to 2030, driven by these advancements. Enhanced sensor capabilities allow for improved target detection, tracking, and identification, which are critical for modern military operations. As the U.S. military continues to prioritize modernization efforts, the demand for advanced sensor technologies is expected to rise, further propelling the military aerospace-sensors market.

Leave a Comment