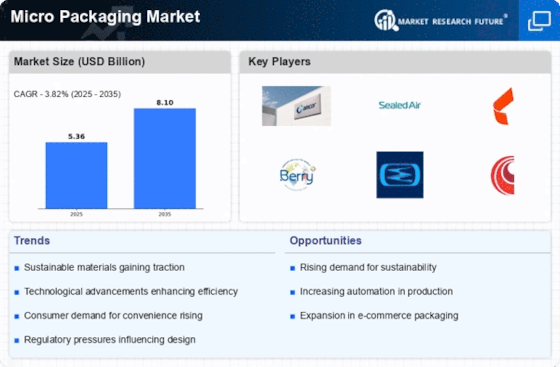

E-commerce Growth

The Micro Packaging Market is experiencing a surge due to the rapid growth of e-commerce. As online shopping becomes more prevalent, the need for efficient and protective packaging solutions has intensified. E-commerce businesses require micro packaging that not only safeguards products during transit but also enhances the unboxing experience for consumers. Recent statistics indicate that e-commerce sales are projected to reach 4 trillion dollars by 2025, driving demand for specialized packaging solutions. Companies that adapt their micro packaging strategies to meet the unique challenges of e-commerce logistics are likely to thrive in this evolving market landscape.

Regulatory Compliance

Regulatory compliance is a critical driver in the Micro Packaging Market. Governments worldwide are implementing stricter regulations regarding packaging materials and waste management. These regulations often mandate the use of recyclable or biodegradable materials, compelling companies to innovate and adapt their packaging solutions. For instance, the European Union has set ambitious targets for reducing plastic waste, which has prompted manufacturers to explore alternative materials. Market data suggests that compliance with these regulations could lead to a 5% increase in operational costs for companies that fail to adapt. Therefore, businesses that proactively align their micro packaging strategies with regulatory requirements are likely to mitigate risks and enhance their market position.

Technological Innovations

Technological innovations play a pivotal role in shaping the Micro Packaging Market. Advancements in materials science and manufacturing processes have led to the development of thinner, lighter, and more durable packaging solutions. For instance, the introduction of nanotechnology in packaging materials enhances barrier properties, extending shelf life and preserving product quality. Furthermore, automation and smart packaging technologies are streamlining production processes, reducing costs, and improving efficiency. Market data indicates that the adoption of smart packaging is expected to increase by 15% annually, driven by consumer demand for enhanced product information and tracking capabilities. These technological advancements are likely to redefine the competitive landscape of the micro packaging sector.

Sustainability Initiatives

The Micro Packaging Market is increasingly influenced by sustainability initiatives. As consumers become more environmentally conscious, there is a growing demand for packaging solutions that minimize waste and utilize recyclable materials. Companies are responding by innovating in biodegradable and compostable packaging options. According to recent data, the market for sustainable packaging is projected to grow at a compound annual growth rate of 7.5% over the next five years. This shift not only aligns with consumer preferences but also helps companies meet regulatory requirements aimed at reducing plastic waste. As a result, businesses that prioritize sustainability in their micro packaging solutions are likely to gain a competitive edge in the market.

Consumer Demand for Convenience

The Micro Packaging Market is significantly driven by consumer demand for convenience. As lifestyles become increasingly fast-paced, consumers are seeking packaging solutions that offer portability and ease of use. This trend is particularly evident in sectors such as food and beverage, where single-serve and ready-to-eat products are gaining popularity. Market analysis reveals that the demand for convenient packaging is expected to grow by 10% over the next few years, as consumers prioritize products that fit seamlessly into their busy lives. Companies that can effectively cater to this demand through innovative micro packaging solutions are likely to enhance customer satisfaction and loyalty.

.png)