Rising Digital Transactions

The transaction monitoring market in Mexico is significantly influenced by the surge in digital transactions. With the rapid adoption of online banking and mobile payment solutions, the volume of transactions has escalated, creating a pressing need for effective monitoring systems. In 2025, it is estimated that digital transactions will account for over 60% of all financial transactions in the country. This shift necessitates the implementation of advanced transaction monitoring solutions capable of handling large volumes of data in real-time. Financial institutions are increasingly recognizing the importance of these systems to mitigate risks associated with fraud and money laundering. Consequently, the transaction monitoring market is expected to expand as organizations seek to enhance their capabilities in monitoring and analyzing digital transactions.

Emerging Cybersecurity Threats

The transaction monitoring market in Mexico is facing challenges from emerging cybersecurity threats. As financial institutions increasingly rely on digital platforms, they become more vulnerable to cyberattacks that can compromise sensitive transaction data. The rise in cybercrime has prompted organizations to invest in advanced transaction monitoring solutions that incorporate cybersecurity measures. In 2025, it is projected that the cost of cybercrime in Mexico will exceed $10 billion, underscoring the urgency for effective monitoring systems. These systems not only help in detecting fraudulent activities but also play a crucial role in safeguarding customer data. As a result, the transaction monitoring market is likely to see a surge in demand for integrated solutions that address both transaction monitoring and cybersecurity concerns.

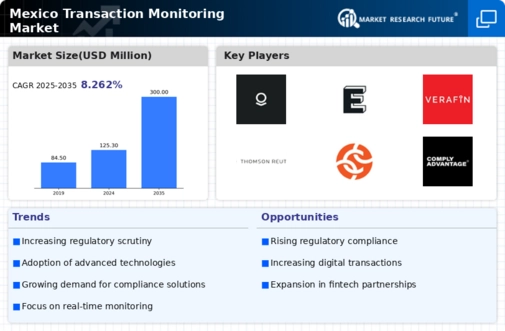

Increasing Regulatory Scrutiny

The transaction monitoring market in Mexico is experiencing heightened regulatory scrutiny due to the need for financial institutions to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. The Mexican government has implemented stringent laws to combat financial crimes, which necessitates robust transaction monitoring systems. As a result, financial institutions are investing heavily in advanced monitoring solutions to ensure compliance. The market is projected to grow at a CAGR of approximately 12% over the next five years, reflecting the urgency for effective monitoring mechanisms. This increasing regulatory pressure is compelling organizations to adopt sophisticated technologies that can efficiently analyze transaction data and flag suspicious activities, thereby enhancing the overall integrity of the financial system in Mexico.

Consumer Demand for Transparency

The transaction monitoring market in Mexico is increasingly shaped by consumer demand for transparency in financial transactions. As customers become more aware of financial crimes and their implications, they are seeking assurance that their financial institutions are taking adequate measures to protect their interests. This demand for transparency is driving financial institutions to adopt more sophisticated transaction monitoring systems that provide real-time insights into transaction activities. In 2025, it is anticipated that over 70% of consumers will prioritize transparency when choosing financial service providers. Consequently, organizations are compelled to enhance their transaction monitoring capabilities to meet these expectations, thereby fostering trust and loyalty among customers.

Integration of Artificial Intelligence

The transaction monitoring market in Mexico is witnessing a transformative shift due to the integration of artificial intelligence (AI) technologies. AI-driven solutions are enabling financial institutions to analyze vast amounts of transaction data more efficiently and accurately. These technologies can identify patterns and anomalies that may indicate fraudulent activities, thereby enhancing the effectiveness of monitoring systems. In 2025, it is projected that AI will account for approximately 30% of the transaction monitoring market, reflecting its growing importance in combating financial crimes. The adoption of AI not only streamlines the monitoring process but also reduces operational costs for financial institutions. As a result, the transaction monitoring market is likely to experience significant growth as organizations increasingly leverage AI to bolster their monitoring capabilities.