Emergence of 5G Technology

The rollout of 5G technology is poised to have a transformative impact on the software defined-networking market in Mexico. With its promise of ultra-fast connectivity and low latency, 5G is expected to drive the demand for advanced networking solutions that can support the increased data traffic and connectivity requirements. As industries such as healthcare, manufacturing, and entertainment begin to leverage 5G capabilities, the need for agile and scalable networking solutions will become paramount. This shift is likely to propel the software defined-networking market forward, as organizations seek to harness the full potential of 5G technology to enhance their operational efficiencies and service offerings.

Government Initiatives and Support

Government initiatives aimed at enhancing digital infrastructure are significantly influencing the software defined-networking market in Mexico. The Mexican government has been actively promoting the adoption of advanced technologies to foster economic growth and innovation. Initiatives such as the National Digital Strategy aim to improve connectivity and digital services across the country. This supportive regulatory environment is likely to encourage investments in software defined networking solutions, as businesses seek to align with national objectives. As a result, the software defined-networking market is expected to benefit from increased funding and resources, facilitating its expansion in the coming years.

Rising Demand for Network Flexibility

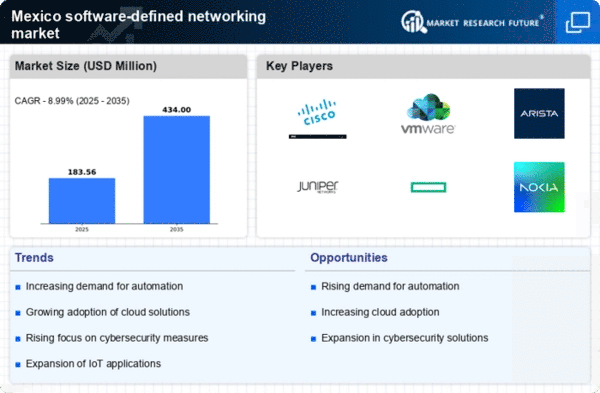

The software defined-networking market in Mexico is experiencing a notable surge in demand for network flexibility. Organizations are increasingly seeking solutions that allow for rapid adjustments to network configurations, enabling them to respond swiftly to changing business needs. This trend is particularly evident in sectors such as telecommunications and finance, where agility is paramount. According to recent data, the market is projected to grow at a CAGR of 25% over the next five years, driven by the need for scalable and adaptable network infrastructures. As businesses continue to embrace digital transformation, the software defined-networking market is likely to play a crucial role in facilitating seamless connectivity and operational efficiency.

Cost Efficiency and Resource Optimization

Cost efficiency remains a pivotal driver in the software defined-networking market in Mexico. Organizations are increasingly recognizing the financial benefits of adopting software-defined solutions, which often lead to reduced operational costs and improved resource allocation. By leveraging virtualization and automation, companies can optimize their network resources, resulting in significant savings. Reports indicate that businesses can achieve up to 30% reduction in network management costs through the implementation of software defined networking technologies. This financial incentive is compelling many Mexican enterprises to transition from traditional networking models to more efficient software-defined alternatives, thereby propelling market growth.

Growing Importance of Data Privacy Regulations

The increasing emphasis on data privacy regulations is shaping the software defined-networking market in Mexico. With the implementation of laws such as the Federal Law on Protection of Personal Data, organizations are compelled to adopt robust networking solutions that ensure compliance and safeguard sensitive information. This regulatory landscape is driving demand for software defined networking technologies that offer enhanced security features and data management capabilities. As companies strive to meet compliance requirements, the software defined-networking market is likely to witness a surge in adoption, as businesses prioritize secure and efficient network solutions.