Emergence of 5G Technology

The rollout of 5G technology is poised to have a transformative impact on the software defined-networking market in Germany. With its promise of ultra-fast connectivity and low latency, 5G is expected to enable new applications and services that require robust networking capabilities. This technological advancement is likely to drive the adoption of software defined networking solutions, as organizations seek to leverage the benefits of 5G. Analysts suggest that the integration of 5G with software defined networking could enhance network performance and scalability, making it a key driver for market growth in the coming years.

Rising Demand for Network Agility

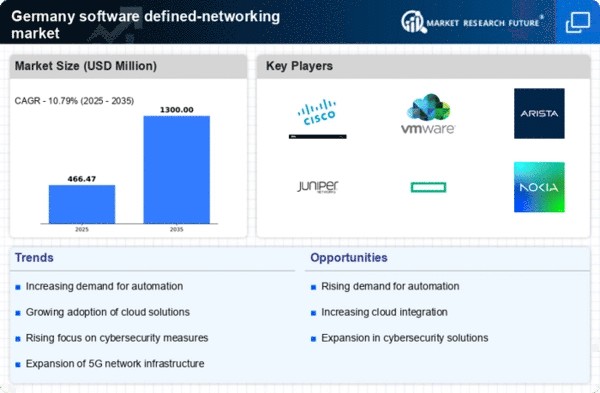

The software defined-networking market in Germany is experiencing a notable surge in demand for network agility.. Organizations are increasingly seeking solutions that allow for rapid adjustments to network configurations, enabling them to respond swiftly to changing business needs. This trend is driven by the necessity for enhanced operational efficiency and the ability to support diverse applications. According to recent data, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is indicative of a broader shift towards more flexible networking solutions, which are essential for maintaining competitive advantage in a fast-paced digital landscape.

Increased Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the software defined-networking market in Germany. Enterprises are under constant pressure to optimize their IT budgets while ensuring robust network performance. The adoption of software defined networking allows organizations to reduce hardware dependency and streamline operations, leading to significant cost savings. Reports indicate that companies can achieve up to 30% reduction in operational costs by transitioning to software defined solutions. This financial incentive is compelling many businesses to invest in software defined networking technologies, thereby propelling market growth.

Growing Need for Enhanced Network Security

As cyber threats continue to evolve, the need for enhanced network security is becoming increasingly paramount in the software defined-networking market in Germany. Organizations are recognizing that traditional security measures may not suffice in the face of sophisticated attacks. Software defined networking offers advanced security features, such as micro-segmentation and automated threat detection, which are essential for safeguarding sensitive data. The market is witnessing a shift towards solutions that prioritize security, with many enterprises investing in software defined networking technologies to bolster their defenses. This heightened focus on security is likely to be a significant driver of market growth.

Regulatory Compliance and Data Sovereignty

In Germany, regulatory compliance and data sovereignty are critical factors influencing the software defined-networking market. With stringent data protection laws such as the GDPR, organizations are compelled to adopt networking solutions that ensure compliance while maintaining data integrity. The software defined-networking market provides the necessary tools to manage data flows and enforce security policies effectively. As businesses navigate the complexities of regulatory requirements, the demand for compliant networking solutions is expected to rise, further driving market expansion. This focus on compliance is likely to shape the development of innovative networking technologies.