Regulatory Support for Market Entry

Regulatory frameworks in Mexico are increasingly supportive of new entrants in the mobile virtual-network-operator market. The Federal Telecommunications Institute (IFT) has implemented policies aimed at fostering competition and reducing barriers to entry for MVNOs. This regulatory environment is conducive to the growth of the mobile virtual-network-operator market, as it allows new players to access existing network infrastructure at reasonable rates. As of 2025, the IFT has reported a 15% increase in the number of MVNO licenses issued, indicating a robust interest in market participation. This regulatory support not only enhances competition but also encourages innovation in service offerings, ultimately benefiting consumers through improved choices and pricing.

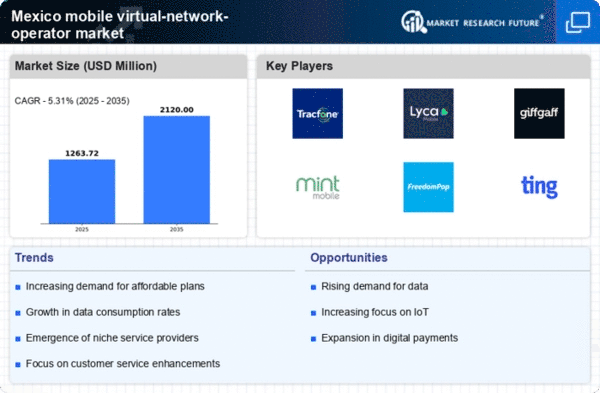

Growing Demand for Affordable Connectivity

The mobile virtual-network-operator market in Mexico is experiencing a notable surge in demand for affordable connectivity solutions. As consumers increasingly seek cost-effective mobile plans, MVNOs are positioned to cater to this need by offering competitive pricing structures. Recent data indicates that approximately 60% of Mexican consumers prioritize price over other factors when selecting mobile services. This trend is further fueled by the rising penetration of smartphones, which has reached around 80% in urban areas. Consequently, MVNOs are likely to expand their offerings to include budget-friendly data packages, thereby attracting a larger customer base. The growing demand for affordable connectivity is a key driver for the mobile virtual-network-operator market, as it encourages innovation and competition among service providers.

Shift Towards Digital Services and E-commerce

The shift towards digital services and e-commerce is reshaping consumer behavior in Mexico, thereby influencing the mobile virtual-network-operator market. As more consumers engage in online shopping and digital transactions, the demand for reliable mobile data services has surged. Recent statistics suggest that approximately 70% of Mexicans use their mobile devices for online purchases, highlighting the necessity for robust mobile connectivity. MVNOs are likely to capitalize on this trend by offering tailored data plans that cater to the needs of e-commerce users. This shift towards digital services not only drives growth in the mobile virtual-network-operator market but also encourages providers to innovate and enhance their service offerings.

Increased Competition and Market Fragmentation

The mobile virtual-network-operator market in Mexico is characterized by increased competition and market fragmentation. With numerous MVNOs entering the market, consumers are presented with a diverse array of service options. This competitive landscape is driving providers to differentiate themselves through unique offerings and pricing strategies. As of November 2025, the number of active MVNOs in Mexico has reached 30, reflecting a 25% increase from the previous year. This heightened competition is likely to lead to improved service quality and lower prices for consumers, as MVNOs strive to capture market share. The dynamic nature of the mobile virtual-network-operator market is indicative of a vibrant ecosystem that fosters innovation and consumer choice.

Technological Advancements in Network Infrastructure

Technological advancements in network infrastructure are significantly impacting the mobile virtual-network-operator market in Mexico. The rollout of 5G technology is expected to revolutionize mobile services, providing faster data speeds and improved connectivity. As of November 2025, major telecommunications companies have invested over $1 billion in upgrading their networks to support 5G capabilities. This technological evolution presents MVNOs with opportunities to offer enhanced services, such as high-definition streaming and IoT solutions. The integration of advanced technologies into the mobile virtual-network-operator market is likely to attract tech-savvy consumers who demand superior performance and reliability from their mobile services.