Enhancement of Supply Chain Management

The enhancement of supply chain management is a critical driver for the industrial analytics market in Mexico. Companies are increasingly leveraging analytics to gain visibility into their supply chains, enabling them to identify bottlenecks, optimize inventory levels, and improve overall efficiency. The ability to analyze data from various sources allows organizations to make proactive decisions that enhance their responsiveness to market demands. Recent studies indicate that companies utilizing analytics in supply chain management can reduce operational costs by up to 15%. This growing emphasis on supply chain optimization is likely to contribute to the expansion of the industrial analytics market, as businesses seek to improve their competitive edge.

Integration of Advanced Analytics Tools

The integration of advanced analytics tools is becoming a pivotal driver for the industrial analytics market in Mexico. Companies are increasingly adopting sophisticated software solutions that leverage machine learning and artificial intelligence to analyze vast amounts of data. This integration allows for real-time insights and predictive analytics, enabling organizations to make informed decisions swiftly. The market for advanced analytics tools is expected to grow at a CAGR of approximately 25% over the next five years. As businesses in Mexico embrace these technologies, the industrial analytics market is likely to expand, fostering innovation and enhancing decision-making capabilities across various sectors.

Rising Demand for Operational Efficiency

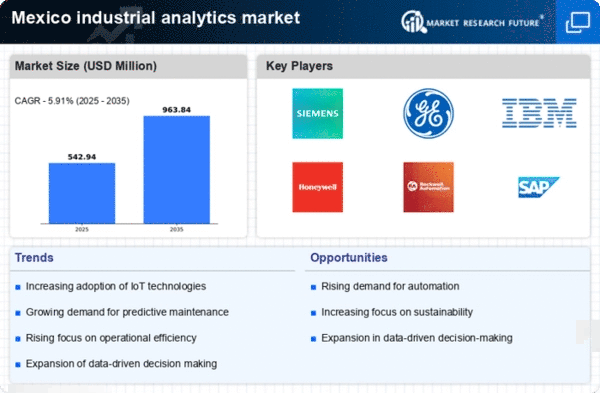

The industrial analytics market in Mexico is experiencing a notable surge in demand for operational efficiency. Companies are increasingly seeking to optimize their processes, reduce waste, and enhance productivity. This trend is driven by the need to remain competitive in a rapidly evolving industrial landscape. According to recent data, organizations that implement analytics solutions can achieve efficiency improvements of up to 30%. As a result, investments in industrial analytics technologies are projected to grow significantly, with estimates suggesting a market value exceeding $1 billion by 2026. This focus on operational efficiency is likely to propel the industrial analytics market forward, as businesses recognize the potential for cost savings and improved performance.

Growing Focus on Sustainability Initiatives

Sustainability initiatives are gaining traction within the industrial analytics market in Mexico. Companies are increasingly recognizing the importance of reducing their environmental footprint and adhering to regulatory requirements. By utilizing analytics, organizations can monitor energy consumption, waste production, and resource utilization more effectively. This focus on sustainability is not only driven by regulatory pressures but also by consumer demand for environmentally responsible practices. As a result, investments in analytics solutions that support sustainability efforts are expected to rise, potentially leading to a market growth of around 20% by 2027. This trend indicates a shift towards more responsible industrial practices, further propelling the industrial analytics market.

Investment in Workforce Training and Development

Investment in workforce training and development is emerging as a significant driver for the industrial analytics market in Mexico. As organizations adopt advanced analytics technologies, there is a growing need for skilled personnel who can effectively utilize these tools. Companies are increasingly investing in training programs to equip their workforce with the necessary skills to analyze data and derive actionable insights. This focus on human capital development is crucial for maximizing the benefits of industrial analytics solutions. It is estimated that organizations that prioritize workforce training can enhance productivity by up to 25%. Consequently, this investment in human resources is likely to stimulate growth in the industrial analytics market, as a skilled workforce is essential for successful implementation.