Rising Focus on Customer Experience

A rising focus on customer experience is significantly impacting the crowd analytics market in Mexico. Businesses are increasingly utilizing crowd analytics to gain insights into consumer behavior, preferences, and engagement levels. This data enables companies to tailor their offerings and improve service delivery, ultimately enhancing customer satisfaction. The retail sector, in particular, is expected to invest heavily in crowd analytics solutions, with projections indicating a market growth of around 20% in this segment alone. This emphasis on customer-centric strategies is likely to propel the crowd analytics market forward, as organizations seek to leverage data for competitive advantage.

Expansion of Retail and Event Industries

The expansion of the retail and event industries in Mexico is significantly influencing the crowd analytics market. As more shopping centers and large-scale events emerge, the need for effective crowd management solutions becomes paramount. Retailers are leveraging crowd analytics to optimize store layouts and enhance customer engagement, while event organizers utilize these insights to ensure safety and improve attendee experiences. The market is projected to reach a valuation of approximately $200 million by 2026, reflecting the increasing investment in crowd analytics technologies. This growth underscores the importance of understanding crowd dynamics in both retail and event contexts.

Government Initiatives for Urban Planning

Government initiatives aimed at urban planning and development are playing a pivotal role in shaping the crowd analytics market in Mexico. Authorities are increasingly adopting crowd analytics to inform infrastructure projects and public transportation systems. By analyzing crowd movement patterns, planners can make data-driven decisions that enhance urban mobility and safety. Recent reports indicate that investments in smart city technologies, including crowd analytics, could exceed $1 billion by 2027. This trend highlights the potential for crowd analytics to contribute to more sustainable and efficient urban environments, thereby driving market growth.

Growing Demand for Real-Time Data Analysis

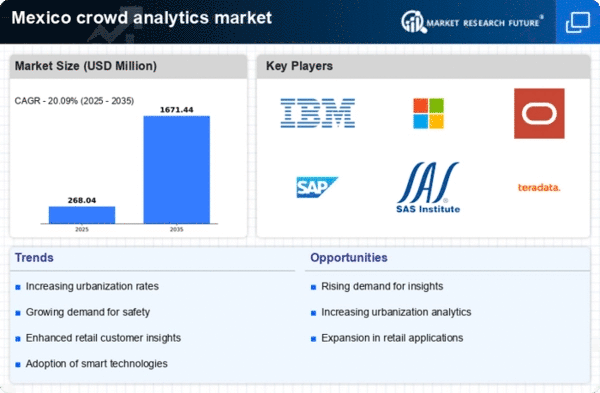

The crowd analytics market in Mexico is experiencing a notable surge in demand for real-time data analysis. Businesses and government entities are increasingly recognizing the value of immediate insights derived from crowd behavior. This trend is particularly evident in sectors such as retail and transportation, where understanding foot traffic patterns can lead to improved operational efficiency. According to recent estimates, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the need for timely decision-making and enhanced customer experiences, positioning real-time data analysis as a critical component of the crowd analytics market.

Technological Advancements in Data Collection

Technological advancements in data collection methods are transforming the crowd analytics market in Mexico. Innovations such as mobile tracking, IoT devices, and advanced video analytics are enabling more accurate and comprehensive data gathering. These technologies facilitate the analysis of large volumes of crowd data, providing actionable insights for businesses and public entities. As these technologies become more accessible, the market is anticipated to grow significantly, with estimates suggesting a potential increase of 30% in adoption rates over the next few years. This trend indicates a shift towards more sophisticated crowd analytics solutions, enhancing the overall market landscape.