Regulatory Incentives for Clean Energy

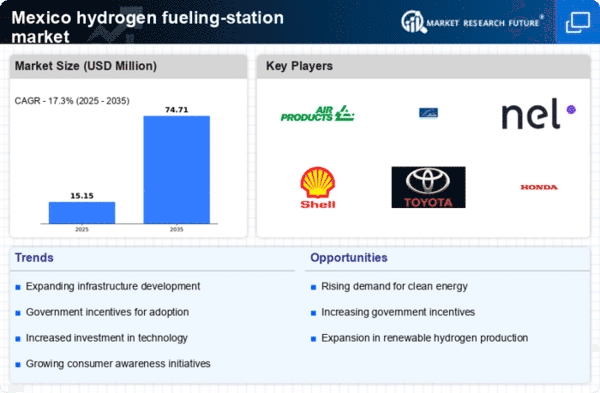

The hydrogen fueling-station market in Mexico is likely to benefit from regulatory incentives aimed at promoting clean energy solutions. The Mexican government has been implementing policies that encourage the adoption of renewable energy sources, including hydrogen. These incentives may include tax breaks, subsidies, and grants for companies investing in hydrogen infrastructure. As a result, the market could see increased investment, potentially leading to a growth rate of around 15% annually. Furthermore, the establishment of a regulatory framework that supports hydrogen production and distribution is essential for the long-term sustainability of the hydrogen fueling-station market.

Investment in Infrastructure Development

Investment in infrastructure development is a critical driver for the hydrogen fueling-station market in Mexico. The government and private sector are increasingly recognizing the need for a robust hydrogen infrastructure to support the growing demand for hydrogen vehicles. This includes the construction of fueling stations, pipelines, and storage facilities. Recent reports indicate that investments in hydrogen infrastructure could reach $500 million by 2027. Such developments not only enhance accessibility for consumers but also stimulate market growth, potentially leading to a 25% increase in the number of hydrogen fueling stations across the country.

Rising Fuel Prices and Economic Viability

The hydrogen fueling-station market in Mexico appears to be influenced by the rising prices of traditional fuels. As gasoline and diesel prices fluctuate, consumers and businesses may seek alternative energy sources that offer cost savings in the long run. Hydrogen, being a clean fuel, presents an attractive option. The economic viability of hydrogen as a fuel source is further supported by the decreasing costs of hydrogen production technologies. This shift could lead to a market growth projection of approximately 20% over the next five years, as more stakeholders recognize the potential of hydrogen fueling stations.

Public Awareness and Education Initiatives

Public awareness and education initiatives are essential for the hydrogen fueling-station market in Mexico. As consumers become more informed about the benefits of hydrogen as a clean energy source, the demand for hydrogen fueling stations is likely to increase. Educational campaigns that highlight the environmental advantages of hydrogen fuel can drive consumer interest and acceptance. Furthermore, collaboration with educational institutions to promote hydrogen technology can foster innovation and research. This growing awareness may contribute to a market growth rate of around 18% as more individuals and businesses consider hydrogen as a viable alternative to traditional fuels.

Collaboration with Automotive Manufacturers

Collaboration between hydrogen fueling-station operators and automotive manufacturers is likely to play a pivotal role in the market's expansion in Mexico. As major automotive companies invest in hydrogen fuel cell technology, the demand for fueling stations is expected to rise. Partnerships between these entities can facilitate the establishment of a comprehensive network of hydrogen stations, ensuring that consumers have convenient access to refueling options. This synergy may lead to a projected growth of 30% in the hydrogen fueling-station market, as more vehicles equipped with hydrogen fuel cells enter the market.