Rising Cyber Threats

The cyber security market in Mexico is experiencing a notable surge. This is due to the increasing frequency and sophistication of cyber threats. Reports indicate that cybercrime incidents have escalated by approximately 30% in recent years, prompting organizations to prioritize their security measures. This trend is particularly evident in sectors such as finance and healthcare, where sensitive data is at risk. As a result, businesses are compelled to invest in advanced security solutions to safeguard their assets and maintain customer trust. The urgency to combat these threats is driving growth in the cyber security market, as companies seek to implement robust defenses against potential breaches.

Increased Regulatory Scrutiny

The cyber security market in Mexico is also shaped by heightened regulatory scrutiny. Government agencies are implementing stricter regulations to protect consumer data and ensure compliance with international standards. For instance, the Federal Law on Protection of Personal Data has prompted organizations to reassess their data protection strategies. Companies that fail to comply with these regulations may face substantial fines, which can reach up to 4% of their annual revenue. This regulatory environment is driving businesses to invest in cyber security solutions to mitigate risks and ensure compliance, thereby fostering growth in the cyber security market.

Growing Awareness of Cyber Risks

There is a marked increase in awareness regarding cyber risks among businesses and consumers in Mexico. Educational campaigns and high-profile cyber incidents have contributed to a heightened understanding of the potential consequences of inadequate security measures. As organizations recognize the financial and reputational damage that can result from cyber attacks, they are more inclined to allocate resources towards cyber security. This growing awareness is likely to propel the cyber security market forward, as companies seek to implement proactive measures to protect their operations and customer data.

Digital Transformation Initiatives

The ongoing digital transformation across various industries in Mexico is significantly influencing the cyber security market. As organizations adopt cloud computing, IoT, and other digital technologies, the attack surface for cyber threats expands. A recent survey revealed that over 60% of companies in Mexico are accelerating their digital initiatives, which inherently increases their vulnerability to cyber attacks. Consequently, there is a growing demand for comprehensive cyber security solutions that can protect these digital infrastructures. This shift not only highlights the necessity for enhanced security measures but also presents opportunities for cyber security providers to offer tailored solutions that address the unique challenges posed by digital transformation.

Investment in Cyber Security Infrastructure

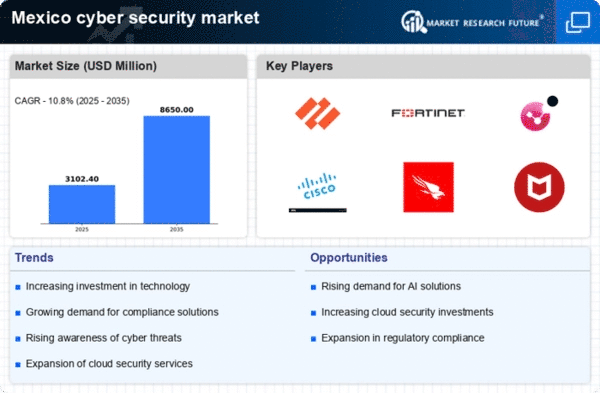

Investment in cyber security infrastructure is becoming a priority for many organizations in Mexico. As businesses face the reality of evolving cyber threats, they are increasingly allocating budgets towards enhancing their security frameworks. Reports suggest that spending on cyber security solutions is expected to grow by over 20% annually in the coming years. This trend reflects a broader recognition of the importance of robust security measures in maintaining operational integrity. The influx of capital into the cyber security market is likely to stimulate innovation and the development of advanced security technologies, further strengthening the industry's position in the Mexican economy.