Market Trends

Key Emerging Trends in the Methyl Cellulose Market

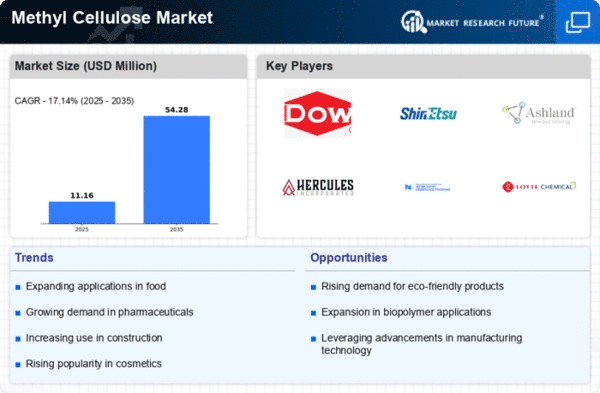

Methyl Cellulose market well-known trends are shaped by its extensive product use spreed in construction, pharmaceutical, food, and personal care industries. One of the most noticeable tendencies in the Methyl Cellulose market is the increasing number of using it in the construction segment. Methyl Cellulose, a hydrophilic polymer, is one of the most widely incorporate emulsifier in sometimes foundation, to stop the water from evaporating in mortars, plasters, and tile adhesives. The cement benefitting the build market through a better workability, adhesion, and mixture consistency is the significant factor in developing dynamics in construction and infrastructure building.

To make our points clear, the pharmaceutical industry is another major consumer of the Methyl Cellulose. This product is picked-up by the pharma industries as binder, disintegrant, and viscosity modifier in tablet and capsule production. The completely inert and non-toxic nature of Methyl Cellulose puts it as the go-to substance for pharmaceutical applications, thereby affecting the market trend in the healthcare and pharmaceutical spheres.

Non-food industry is another big factor for market share for Methyl Cellulose. Methylcellulose is used in the food industry as a thickener, stabilizer and emulsifier in many different products, ranging from tomato sauces to bakery items. Aligned with the consumers' preference of clean label and plant-based components, Methyl Cellulose presents itself as a compelling and suitable ingredient which may consequently result in increased adoption rate of the food industry positively affecting the market dynamics

The Personal Care and Cosmetics Sectors that also generate great demand in Methyl Cellulose. It is a very popular ingredient incorporated into the product like creams, lotions, and hair products for more thickening, stability etc. The capacity of Methyl Cellulose to upgrading ccosmetic products texture as well as stability drives the rapid growth of industry due to its emphasis on product performance and consumer experience; subsequent market trends of personal care industry are also inspired.

The significance of technological innovations cannot be refuted when it comes to determining the trends in the market of methyl cellulose ingredients. Continuing efforts are spent on the work of investigating, designing and modifying the functionality and properties for multiple uses of methyl cellulose. Rationalizations in production processes, along with restructuring in molecular configurations, becomes the root of the development of adjustable Methyl Cellulose that could conform to industry expectary requirements and in effect, affect market trends.

Regarding geographical distribution, the production of Methyl Cellulose market has considerable variation among regions. Developed or emerging nations, whose basic industries, such as construction, pharmaceuticals, and food industries, have expanded in recent times, especially Asia and America display higher adoption of Methyl Cellulose. Stakeholders often seek to exploit these regions more purposefully, in order to tap into the emerging markets, while at the same time enabling industries to meet local requirements.

Leave a Comment