Meter Data Management Market Summary

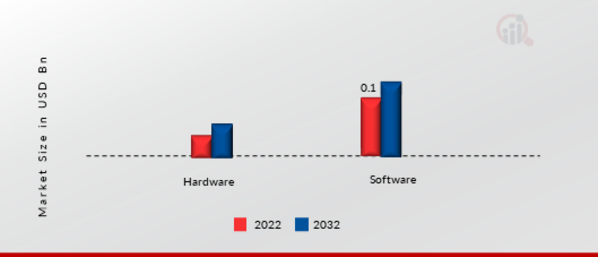

As per Market Research Future Analysis, the Global Meter Data Management Market was valued at USD 588.94 Million in 2024 and is projected to reach USD 1685.70 Million by 2035, growing at a CAGR of 10.03% from 2025 to 2035. The market growth is driven by the rise in advanced metering infrastructure adoption and increasing meter data volume. Smart meters enhance energy management by providing real-time consumption data, which helps users optimize their energy usage and reduce costs. The Software Segment Dominates The market, while hardware is the fastest-growing category. The electricity utility type leads the market, with gas being the fastest-growing segment. The residential end-user segment holds the largest share, while commercial is the fastest-growing category. North America is the largest market, followed by Europe and Asia-Pacific.

Key Market Trends & Highlights

The meter data management market is witnessing significant growth due to technological advancements and regulatory support.

- Market Size in 2024: USD 588.94 Million; projected to reach USD 1685.70 Million by 2035.

- CAGR from 2025 to 2035: 10.03%; driven by advanced metering infrastructure and increased data volume.

- Electricity segment dominated in 2021; gas is the fastest-growing utility type.

- Residential segment held the largest share in 2021; commercial is the fastest-growing end-user category.

Market Size & Forecast

| 2024 Market Size | USD 588.94 Million |

| 2035 Market Size | USD 1685.70 Million |

| CAGR from 2024 to 2035 | 10.03% |

Major Players

Key players include Eaton (Ireland), ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Honeywell (US), Itron (US), and Landis+Gyr (Switzerland).