Supply Chain Developments

Supply chain developments are increasingly influencing the Global Metals in EV Battery Market Industry. As the demand for electric vehicles escalates, the need for a reliable supply of critical metals becomes paramount. Efforts to establish sustainable and ethical sourcing practices are gaining traction, with companies seeking to mitigate risks associated with supply chain disruptions. This focus on sustainability is likely to enhance the reputation of manufacturers and attract environmentally conscious consumers. Furthermore, as the market evolves, the establishment of local supply chains may reduce dependency on imports, thereby stabilizing prices and ensuring a steady flow of materials necessary for battery production.

Growing Focus on Sustainability

The growing focus on sustainability is reshaping the Global Metals in EV Battery Market Industry. As environmental concerns gain prominence, stakeholders are increasingly prioritizing the use of recycled materials in battery production. This shift not only reduces the demand for virgin metals but also minimizes the environmental impact associated with mining. Companies are exploring innovative recycling technologies to reclaim valuable metals from used batteries, thereby creating a circular economy. This trend aligns with global sustainability goals and is expected to drive market growth, as consumers and manufacturers alike seek greener alternatives in the electric vehicle sector.

Government Incentives and Policies

Government incentives and policies play a crucial role in shaping the Global Metals in EV Battery Market Industry. Many countries are offering subsidies, tax breaks, and grants to promote electric vehicle adoption, which in turn stimulates demand for battery metals. For instance, initiatives aimed at reducing carbon footprints and enhancing energy security are encouraging investments in battery production. These supportive measures are expected to contribute to the market's growth, with projections indicating a rise from 25 USD Billion in 2024 to 75 USD Billion by 2035. Such policies not only bolster the demand for electric vehicles but also create a favorable environment for metal suppliers.

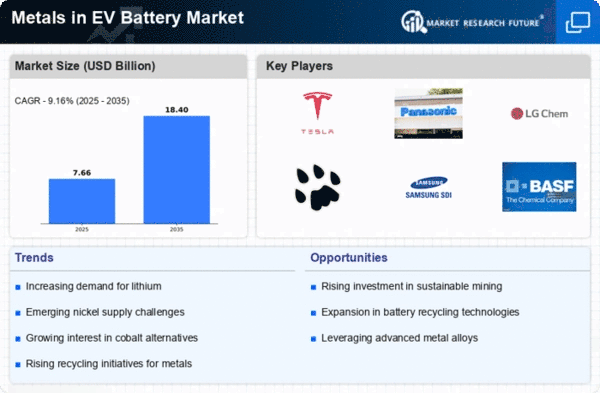

Rising Demand for Electric Vehicles

The increasing global demand for electric vehicles is a primary driver of the Global Metals in EV Battery Market Industry. As governments worldwide implement stringent emissions regulations and consumers seek sustainable transportation options, the adoption of electric vehicles is projected to surge. In 2024, the market is valued at approximately 25 USD Billion, reflecting a robust growth trajectory. This trend is expected to continue, with the market potentially reaching 75 USD Billion by 2035. The shift towards electric mobility necessitates a significant supply of metals such as lithium, cobalt, and nickel, which are essential for battery production.

Technological Advancements in Battery Chemistry

Technological advancements in battery chemistry are transforming the Global Metals in EV Battery Market Industry. Innovations in lithium-ion and solid-state batteries enhance energy density, efficiency, and safety, thereby increasing the appeal of electric vehicles. These advancements often require new metal compositions, which could drive demand for specific materials. As manufacturers invest in research and development, the market is likely to witness a compound annual growth rate of 10.5% from 2025 to 2035. This growth is indicative of the industry's commitment to improving battery performance and longevity, which is crucial for consumer acceptance and market expansion.