Rising Demand for Electronics

The Global Transition Metals Market Industry experiences a surge in demand driven by the electronics sector. Transition metals such as copper, silver, and gold are integral to the production of electronic components, including semiconductors and circuit boards. As technology advances, the need for high-performance materials increases, leading to an estimated market value of 1036.6 USD Billion in 2024. This growth is further fueled by the proliferation of smart devices and renewable energy technologies, which require efficient conductive materials. The industry's responsiveness to these trends suggests a robust trajectory as it adapts to the evolving landscape of electronics.

Infrastructure Development Initiatives

Infrastructure development remains a pivotal driver for the Global Transition Metals Market Industry. Governments worldwide are investing heavily in infrastructure projects, including transportation, energy, and urban development. Transition metals like steel, aluminum, and nickel are essential for construction and manufacturing processes. The anticipated growth in infrastructure spending is expected to contribute to a market valuation of 1682.2 USD Billion by 2035. This investment not only stimulates demand for transition metals but also encourages innovation in material science, potentially leading to more sustainable practices within the industry.

Advancements in Renewable Energy Technologies

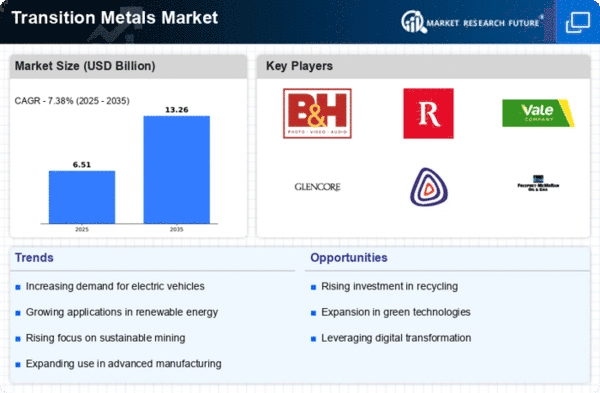

The Global Transition Metals Market Industry is significantly influenced by advancements in renewable energy technologies. Transition metals, particularly lithium, cobalt, and nickel, play a crucial role in the production of batteries for electric vehicles and energy storage systems. As the world shifts towards sustainable energy solutions, the demand for these metals is projected to grow. The industry is likely to see a compound annual growth rate of 4.5% from 2025 to 2035, reflecting the increasing reliance on renewable energy sources. This trend underscores the importance of transition metals in facilitating the global energy transition.

Technological Innovations in Metal Extraction

Technological innovations in metal extraction processes are reshaping the Global Transition Metals Market Industry. Advances in hydrometallurgy and pyrometallurgy enhance the efficiency of metal recovery from ores, thereby reducing costs and environmental impact. These innovations not only improve yield but also enable the extraction of metals from lower-grade ores, expanding the resource base. As a result, the industry is better positioned to meet the growing demand for transition metals, particularly in sectors such as construction and automotive manufacturing. This evolution in extraction technology is likely to play a crucial role in sustaining market growth.

Increasing Focus on Recycling and Circular Economy

The Global Transition Metals Market Industry is witnessing a growing emphasis on recycling and the circular economy. As resource scarcity becomes a pressing concern, the recycling of transition metals such as aluminum, copper, and rare earth elements is gaining traction. This shift not only conserves natural resources but also reduces environmental impact associated with mining. The industry's adaptation to these practices is indicative of a broader trend towards sustainability. By integrating recycling processes, the market can potentially enhance its resilience and ensure a steady supply of transition metals in the face of fluctuating demand.