-

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Markets Structure

-

Market Research Methodology

-

Research Production Method

-

Secondary Research

-

Primary Research

-

Forecast Model

-

Market Landscape

-

Five Forces Analysis

- Threat of New Entrants

- Bargaining power of buyers

- Threat of substitutes

- Segment rivalry

-

Value Chain/Supply Chain of Global Metal Powder Market

-

Industry Overview of Global Metal Powder Market

-

Introduction

-

Growth Drivers

-

Impact analysis

-

Market Challenges

-

Market Trends

-

Introduction

-

Growth Trends

-

Impact analysis

-

Global Metal Powder Market by Type

-

Introduction

-

Non Ferrous

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Ferrous

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Global Metal Powder Market by Compaction Technique

-

Introduction

-

Cold Compassion Technique

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Hot Compassion Technique

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Global Metal Powder Market by Production Method

-

Introduction

-

Physical Production Method

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Chemical Production Method

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Mechanical Production Method

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Global Metal Powder Market by End-use

-

Introduction

-

Transportation

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Building & Construction

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Electrical and Electronics

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Industrial

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Others

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Global Metal Powder Market by Region

-

Introduction

-

North America

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Type, 2022-2030

- Market Estimates & Forecast by Compaction Technique, 2022-2030

- Market Estimates & Forecast by Production Method, 2022-2030

- Market Estimates & Forecast by End-use, 2022-2030

- U.S.

- Mexico

- Canada

-

Europe

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Type, 2022-2030

- Market Estimates & Forecast by Compaction Technique, 2022-2030

- Market Estimates & Forecast by Production Method, 2022-2030

- Market Estimates & Forecast by End-use, 2022-2030

- Germany

- France

- Italy

- Spain

- UK

-

Asia Pacific

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Type, 2022-2030

- Market Estimates & Forecast by Compaction Technique, 2022-2030

- Market Estimates & Forecast by Production Method, 2022-2030

- Market Estimates & Forecast by End-use, 2022-2030

- China

- India

- Japan

- Australia

- New Zealand

- Rest of Asia Pacific

-

11.4.10.5Market Estimates & Forecast by End-use, 2022-2030

-

Middle East & Africa

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Type, 2022-2030

- Market Estimates & Forecast by Compaction Technique, 2022-2030

- Market Estimates & Forecast by Production Method, 2022-2030

- Market Estimates & Forecast by End-use, 2022-2030

- Turkey

- Israel

- North Africa

- GCC

- Rest of Middle East & Africa

-

11.5.8.5Market Estimates & Forecast by End-use, 2022-2030

-

11.5.10.5Market Estimates & Forecast by End-use, 2022-2030

-

Latin America

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Type, 2022-2030

- Market Estimates & Forecast by Compaction Technique, 2022-2030

- Market Estimates & Forecast by Production Method, 2022-2030

- Market Estimates & Forecast by End-use, 2022-2030

- Brazil

- Argentina

- Rest of Latin America

-

Company Landscape

-

Company Profiles

-

Sandvik AB

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Carpenter Technology Corporation

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Hoganas AB

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

GKN Plc

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Rio Tinto

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Allegheny Technologies Incorporated

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

American Chemet Corporation

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Carl Schlenk AG

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Hitachi Chemical Co., Ltd

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Metaldyne performance Group inc.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Conclusion

-

LIST OF TABLES

-

World Population by Major Regions (2022 To 2027)

-

Global Metal Powder Market: By Region, 2022-2030

-

North America Metal Powder Market: By Country, 2022-2030

-

Europe Metal Powder Market: By Country, 2022-2030

-

Asia-Pacific Metal Powder Market: By Country, 2022-2030

-

Middle East & Africa Metal Powder Market: By Country, 2022-2030

-

Latin America Metal Powder Market: By Country, 2022-2030

-

Global Metal Powder by Type Market: By Regions, 2022-2030

-

North America Metal Powder by Type Market: By Country, 2022-2030

-

Table10 Europe Metal Powder by Type Market: By Country, 2022-2030

-

Table11 Asia-Pacific Metal Powder by Type Market: By Country, 2022-2030

-

Table12 Middle East & Africa Metal Powder by Type Market: By Country, 2022-2030

-

Table13 Latin America Metal Powder by Type Market: By Country, 2022-2030

-

Table14 Global Metal Powder by Compaction Technique Market: By Regions, 2022-2030

-

Table15 North America Metal Powder by Compaction Technique Market: By Country, 2022-2030

-

Table16 Europe Metal Powder by Compaction Technique Market: By Country, 2022-2030

-

Table17 Asia-Pacific Metal Powder by Compaction Technique Market: By Country, 2022-2030

-

Table18 Middle East & Africa Metal Powder by Compaction Technique Market: By Country, 2022-2030

-

Table19 Latin America Metal Powder by Compaction Technique Market: By Country, 2022-2030

-

Global Metal Powder by Production Method Market: By Regions, 2022-2030

-

North America Metal Powder by Production Method Market: By Country, 2022-2030

-

Europe Metal Powder by Production Method Market: By Country, 2022-2030

-

Asia-Pacific Metal Powder by Production Method Market: By Country, 2022-2030

-

Middle East & Africa Metal Powder by Production Method Market: By Country, 2022-2030

-

Latin America Metal Powder by Production Method Market: By Country, 2022-2030

-

Table26 Global Metal Powder by End-use Market: By Regions, 2022-2030

-

Table27 North America Metal Powder by End-use Market: By Country, 2022-2030

-

Table28 Europe Metal Powder by End-use Market: By Country, 2022-2030

-

Table29 Asia-Pacific Metal Powder by End-use Market: By Country, 2022-2030

-

Table30 Middle East & Africa Metal Powder by End-use Market: By Country, 2022-2030

-

Table31 Latin America Metal Powder by End-use Market: By Country, 2022-2030

-

Table32 Global Type Market: By Region, 2022-2030

-

Table33 Global Compaction Technique Market: By Region, 2022-2030

-

Table34 Global Compaction Technique Market: By Region, 2022-2030

-

Table35 North America Metal Powder Market, By Country

-

Table36 North America Metal Powder Market, By Type

-

Table37 North America Metal Powder Market, By Compaction Technique

-

Table38 North America Metal Powder Market, By Production Method

-

Table39 North America Metal Powder Market, By End-use

-

Table40 Europe: Metal Powder Market, By Country

-

Table41 Europe: Metal Powder Market, By Type

-

Table42 Europe: Metal Powder Market, By Compaction Technique

-

Table43 Europe: Metal Powder Market, By Production Method

-

Europe: Metal Powder Market, By End-use

-

Table45 Asia-Pacific: Metal Powder Market, By Country

-

Table46 Asia-Pacific: Metal Powder Market, By Type

-

Table47 Asia-Pacific: Metal Powder Market, By Compaction Technique

-

Table48 Asia-Pacific: Metal Powder Market, By Production Method

-

Asia-Pacific: Metal Powder Market, By End-use

-

Table50 Middle East & Africa: Metal Powder Market, By Country

-

Table51 Middle East & Africa Metal Powder Market, By Type

-

Table52 Middle East & Africa Metal Powder Market, By Compaction Technique

-

Table53 Middle East & Africa: Metal Powder Market, By Production Method

-

Table54 Middle East & Africa: Metal Powder Market, By End-use

-

Table55 Latin America: Metal Powder Market, By Country

-

Table56 Latin America Metal Powder Market, By Type

-

Table57 Latin America Metal Powder Market, By Compaction Technique

-

Table58 Latin America: Metal Powder Market, By Production Method

-

Table59 Latin America: Metal Powder Market, By End-use

-

LIST OF FIGURES

-

Global Metal Powder market segmentation

-

Forecast Methodology

-

Five Forces Analysis of Global Metal Powder Market

-

Value Chain of Global Metal Powder Market

-

Share of Global Metal Powder Market in 2022, by country (in %)

-

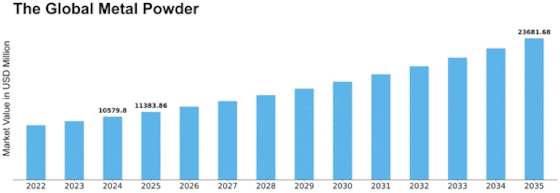

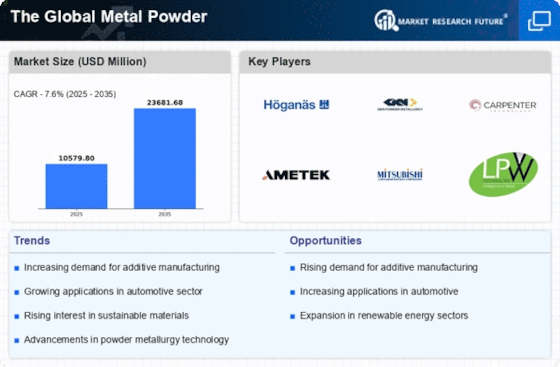

Global Metal Powder Market, 2022-2030,

-

Sub segments of Type

-

Global Metal Powder Market size by Type, 2022

-

Share of Global Metal Powder Market by Type, 2022-2030

-

Global Metal Powder Market size by Compaction Technique, 2022

-

Share of Global Metal Powder Market by Compaction Technique, 2022-2030

-

Global Metal Powder Market size by Production Method, 2022

-

Share of Global Metal Powder Market by Production Method, 2022-2030

-

Global Metal Powder Market size by End-use, 2022-2030

-

Share of Global Metal Powder Market by End-use, 2022-2030

Leave a Comment