Technological Innovations

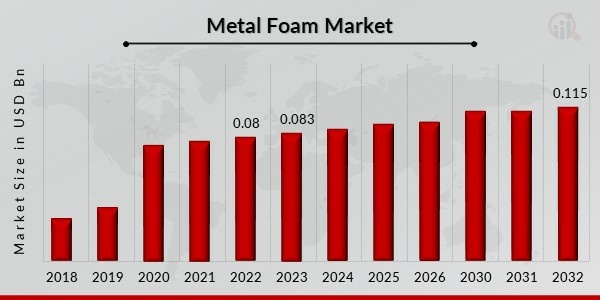

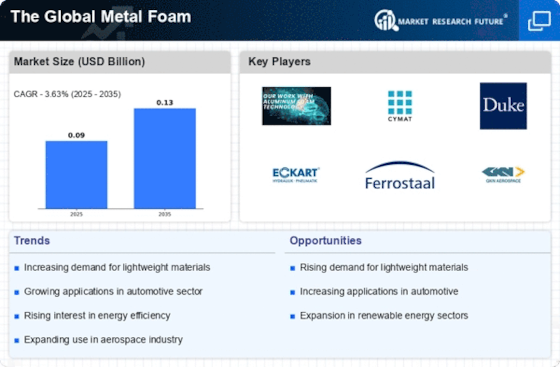

Technological advancements are likely to play a pivotal role in shaping The Global Metal Foam Industry. Innovations in manufacturing processes, such as additive manufacturing and advanced casting techniques, enable the production of metal foams with enhanced properties. These innovations not only improve the mechanical performance of metal foams but also reduce production costs, making them more accessible to a wider range of industries. For instance, the introduction of new alloys and composite materials is expanding the application scope of metal foams in sectors like construction and electronics. The market is expected to witness a surge in demand as these technologies mature, potentially leading to a market valuation exceeding USD 1 billion by 2030. This growth trajectory suggests that companies investing in research and development may gain a competitive edge in the evolving landscape.

Sustainability Initiatives

The increasing emphasis on sustainability appears to drive The Global Metal Foam Industry. As industries seek to reduce their carbon footprints, metal foams, known for their lightweight and energy-efficient properties, are gaining traction. These materials are often utilized in applications such as automotive and aerospace, where reducing weight can lead to lower fuel consumption and emissions. The market for metal foams is projected to grow at a compound annual growth rate of approximately 10% over the next five years, indicating a robust demand for sustainable materials. Furthermore, the recycling potential of metal foams enhances their appeal, aligning with global sustainability goals. Companies are increasingly adopting metal foams in their products, which may lead to a significant shift in material selection across various sectors.

Growth in Aerospace Applications

The aerospace industry is experiencing a notable increase in the adoption of metal foams, which serves as a key driver for The Global Metal Foam Industry. The lightweight nature of metal foams contributes to fuel efficiency, a critical factor in aerospace design. Applications range from structural components to thermal management systems, where metal foams can effectively dissipate heat. The market for aerospace metal foams is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 12% over the next decade. This growth is fueled by the ongoing demand for advanced materials that enhance aircraft performance and reduce operational costs. As aerospace manufacturers continue to innovate, the integration of metal foams is likely to become more prevalent, indicating a robust future for this segment of the market.

Rising Demand in Automotive Sector

The automotive sector's growing demand for lightweight materials is a significant driver for The Global Metal Foam Industry. As manufacturers strive to enhance fuel efficiency and performance, metal foams offer an attractive solution due to their unique properties, such as high strength-to-weight ratios and excellent energy absorption capabilities. The integration of metal foams in vehicle components, such as crash structures and sound insulation, is becoming increasingly common. Recent studies indicate that the automotive industry accounts for nearly 40% of the total metal foam consumption, underscoring its importance in this market. As electric vehicles gain popularity, the need for lightweight materials is expected to escalate, further propelling the demand for metal foams. This trend suggests a promising outlook for manufacturers catering to the automotive sector.

Emerging Markets and Industrial Growth

Emerging markets are increasingly contributing to the expansion of The Global Metal Foam Industry. Rapid industrialization in regions such as Asia-Pacific and Latin America is driving the demand for advanced materials, including metal foams. These regions are witnessing significant investments in infrastructure and manufacturing, which may lead to a surge in applications for metal foams in construction, automotive, and consumer goods. The market in Asia-Pacific alone is expected to grow at a rate of approximately 15% annually, reflecting the region's burgeoning industrial base. Additionally, the rising middle class in these markets is likely to increase consumer demand for lightweight and efficient products. This trend suggests that manufacturers focusing on these emerging markets could capitalize on the growing opportunities presented by the expanding metal foam applications.