Growth in Household Cleaning Products

The Low Foam Surfactants Market is also benefiting from the increasing demand for household cleaning products. As consumers become more conscious of the environmental impact of their cleaning choices, there is a growing preference for low foam formulations that are effective yet eco-friendly. The household cleaning segment is expected to witness a growth rate of around 4% annually, which suggests a robust market for low foam surfactants. These surfactants provide effective cleaning while minimizing residue, making them ideal for use in multipurpose cleaners and dishwashing liquids. The trend towards sustainable and efficient cleaning solutions is likely to further bolster the Low Foam Surfactants Market, as manufacturers innovate to meet these evolving consumer expectations.

Industrial Applications and Efficiency

The Low Foam Surfactants Market is significantly influenced by the rising adoption of low foam surfactants in various industrial applications. Industries such as textiles, agriculture, and food processing are increasingly utilizing these surfactants due to their efficiency in reducing foam during production processes. For instance, in textile manufacturing, low foam surfactants enhance dyeing and finishing processes, leading to improved product quality and reduced water usage. The industrial segment is projected to grow steadily, with an estimated increase of 3% annually, indicating a sustained demand for low foam surfactants. This trend highlights the versatility of low foam surfactants and their critical role in enhancing operational efficiency across multiple sectors, thereby driving the overall growth of the Low Foam Surfactants Market.

Innovation in Formulation Technologies

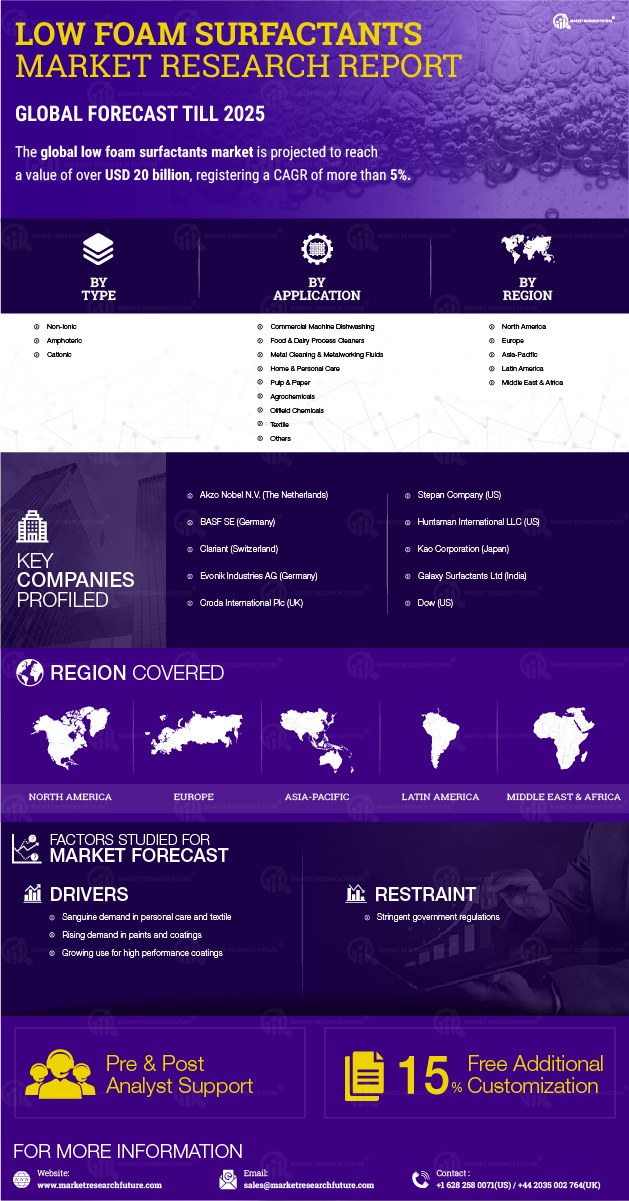

The Low Foam Surfactants Market is witnessing a surge in innovation, particularly in formulation technologies. Manufacturers are increasingly investing in research and development to create advanced low foam surfactants that offer superior performance while meeting consumer demands for sustainability. Innovations such as bio-based surfactants and multifunctional formulations are gaining traction, as they provide enhanced cleaning power with reduced environmental impact. This trend is expected to propel the market forward, with a projected growth rate of 5% in the coming years. As companies strive to differentiate their products in a competitive landscape, the emphasis on innovative formulation technologies is likely to play a pivotal role in shaping the future of the Low Foam Surfactants Market.

Rising Demand in Personal Care Products

The Low Foam Surfactants Market is experiencing a notable increase in demand, particularly within the personal care sector. Consumers are increasingly favoring products that offer effective cleansing without excessive foam, as this aligns with their preferences for gentler formulations. The market for personal care products is projected to grow at a compound annual growth rate of approximately 5% over the next few years, which is likely to drive the demand for low foam surfactants. These surfactants are particularly valued in formulations for shampoos, body washes, and facial cleansers, where a balance between cleansing efficacy and skin compatibility is essential. As manufacturers respond to consumer preferences, the Low Foam Surfactants Market is poised for expansion, reflecting a shift towards more sophisticated and consumer-friendly product offerings.

Regulatory Support for Eco-Friendly Products

The Low Foam Surfactants Market is positively impacted by increasing regulatory support for eco-friendly products. Governments and regulatory bodies are implementing stringent guidelines aimed at reducing the environmental footprint of chemical products, which encourages the adoption of low foam surfactants. These surfactants often comply with environmental regulations due to their reduced impact on aquatic life and lower toxicity levels. As a result, manufacturers are more inclined to develop and market low foam formulations that align with these regulations. The regulatory landscape is expected to evolve, potentially leading to a market growth rate of 4% in the next few years. This supportive environment for eco-friendly products is likely to enhance the Low Foam Surfactants Market, as companies adapt to meet both consumer and regulatory expectations.