Rising Demand in Agriculture

The Global Metal Carboxylates Market Industry is experiencing a surge in demand due to the increasing utilization of metal carboxylates as effective agricultural additives. These compounds serve as essential components in fertilizers and pesticides, enhancing nutrient absorption and crop yield. As global food production needs escalate, driven by population growth and changing dietary patterns, the market for metal carboxylates is projected to grow. This trend is particularly evident in regions with intensive agricultural practices, where the market is expected to contribute significantly to the overall growth of the industry.

Growth in Coatings and Paints Sector

The Global Metal Carboxylates Market Industry benefits from the expanding coatings and paints sector, where metal carboxylates are utilized as drying agents and catalysts. The increasing demand for high-performance coatings in automotive, construction, and industrial applications drives this growth. As environmental regulations become more stringent, the shift towards eco-friendly and low-VOC formulations further propels the adoption of metal carboxylates. This sector is anticipated to play a crucial role in the market's expansion, with projections indicating a market value of 6.15 USD Billion in 2024, reflecting the growing significance of these compounds in modern coatings.

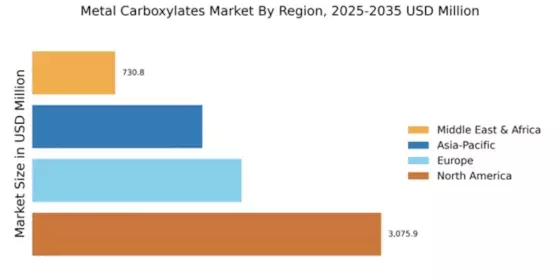

Emerging Markets and Global Expansion

The Global Metal Carboxylates Market Industry is poised for growth as emerging markets, particularly in Asia-Pacific and Latin America, continue to expand their industrial bases. Increased urbanization and economic development in these regions are driving demand for metal carboxylates across various applications, including agriculture, coatings, and pharmaceuticals. As these markets mature, the adoption of advanced chemical products is likely to rise, further fueling the industry's growth. This trend suggests a promising outlook for metal carboxylates, as they become integral to the evolving industrial landscape in these regions.

Advancements in Chemical Manufacturing

Technological advancements in chemical manufacturing processes are poised to enhance the production efficiency of metal carboxylates, thereby impacting the Global Metal Carboxylates Market Industry positively. Innovations such as green chemistry and sustainable production methods are likely to reduce costs and improve yield. This evolution in manufacturing practices aligns with global sustainability goals, making metal carboxylates more appealing to manufacturers and consumers alike. As these advancements continue, the market is expected to witness a compound annual growth rate of 5.28% from 2025 to 2035, indicating a robust future for the industry.

Increasing Applications in Pharmaceuticals

The Global Metal Carboxylates Market Industry is witnessing growth due to the expanding applications of metal carboxylates in the pharmaceutical sector. These compounds are utilized as intermediates in drug synthesis and as stabilizers in formulations. The rising demand for innovative drug delivery systems and the development of new therapeutics are driving this trend. As pharmaceutical companies seek to enhance the efficacy and stability of their products, the role of metal carboxylates becomes increasingly critical. This sector's growth is expected to contribute significantly to the overall market, particularly as the industry anticipates reaching a value of 10.8 USD Billion by 2035.