Metal Carboxylates Size

Metal Carboxylates Market Growth Projections and Opportunities

Various factors influence the growth and dynamics of the Metal Carboxylates Market. The fact that metal carboxylates are used widely as catalysts and stabilizers in the production of polymers, resins and coatings is a key driver. These compounds, known as metal soaps, have excellent catalytic as well as stabilizing properties which are essential in the manufacturing processes of many industrial products.

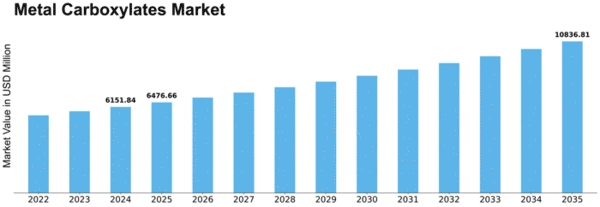

On the other hand, the demand for metal carboxylates is influenced by the growth in end-use industries such as paints and coatings, plastics and adhesives which has led to market expansion. In 2021, Metal Carboxylates Market Size was valued at USD 5,271 million. The Metal Carboxylates market size will grow from USD 5,271.6 million in 2022 to USD 7,964.2 million in 2030 at a CAGR of 5.28%.

Additionally, construction industry especially contributes to shaping of this market of metal carboxylates. This results into coatings with long lasting attributes that enhance durability and aesthetic appeal on architectural structures since these agents are extensively employed as driers alongside paints or varnishes [8]. Worldwide increase in construction activities caused by urbanization coupled with infrastructural development and rehabilitation projects drives up demand for metal carboxylates based corrosion resistant coatings with improved drying times.

Moreover, automotive sector is one of themajor consumer areas for metal carboxylates since they find wide usage within automobiles’ coating industry . These substances act like cross linkers or stabilizers that help enhance performance properties including adhesion strength resistance against rusting or weathering resistance [8]. Automobile manufacturers increasingly put emphasis on excellence finishings together with durability thereby raising demand for metallic salt catalysts applicable to automobile paints.

The overall growth of chemical industry is also contributing factor for metal carboxylates due to its application in different chemical processes. Metal carboxylates function as catalysts and reaction accelerators during the synthesis of polymers, polyesters and other chemicals. The vast range of applications for metal carboxylates make them vital components in chemical manufacturing which determines the overall market dynamics.

Moreover, the global shift towards environmentally friendly solutions and regulatory considerations also impact on the metal carboxylates market. The demand for metal carboxylates that are eco-friendly is rising due to tightening environmental regulations. Manufacturers are developing formulations that contain no heavy metals and are low in volatile organic compounds (VOC) to comply with environment regulations as well as cater for the preference of industries and consumers who prefer sustainable products.

Consequently, some challenges may be faced by the metal carboxylate market due to some factors such as fluctuation in prices of raw materials notably metals along with economic uncertainties that might occur. This can also affect production costs of these substances[3]. On the other hand, general economic instability may cause changes within industry thereby influencing overall consumption levels for all types of these compounds.

Leave a Comment