Research Methodology on the Metal Cans Market

1. Introduction

This research methodology on the Metal Cans Market is created to gather accurate data and arrive at precise conclusions to analyze the potential of the market. The research process is designed to focus specifically on the current industry trends to better understand the metal cans market and its implications for the growth of other industries. The research methodology applied in this study involves both primary and secondary information. The primary information is collected by interviewing metal cans market stakeholders while the secondary information is collected from relevant sources such as market research reports, company websites, and press releases.

2. Objective

The objective of this research is to provide an extensive market analysis of the metal cans market by studying the drivers, trends, and future prospects of this market. The study also aims to analyze the competitive landscape of the metal cans market to gain a thorough understanding of the market dynamics.

3. Scope of the Research

This research focuses on the market analysis of metal cans, which are used for packaging tin, steel, aluminium, and other metals. The market has witnessed steady growth over the past few years due to increased demand for metal cans for packaging purposes. The research includes a detailed analysis of the market size, leading players, and growth prospects in the global metal cans market.

4. Research Methodology

To conduct the research, a holistic approach is adopted, utilizing both primary and secondary research methodologies.

4.1 Primary Research

Primary research is conducted to collect the necessary information and data from key stakeholders, such as manufacturers, suppliers, distributors, and industry experts with experience and knowledge related to the metal cans market. The process entailed semi-structured interviews with several key players, which focused on their understanding of the metal cans market. The information gathered through these interviews is used to analyze the current trends, emerging growth opportunities, and future prospects of the metal cans market.

4.2 Secondary Research

To gain detailed information related to the metal cans market, comprehensive secondary research is conducted. Secondary research sources include market reports, industry white papers, and annual reports from the respective companies. Alternatively, industry-related databases such as Bloomberg, Factiva, LexisNexis, ProQuest, and Google Scholar were also consulted for the data-driven analysis of the metal cans market.

5. Market Segmentation

The study focused on analyzing the global metal cans market which is divided into the following segments.

5.1. By Product Type

- Steel Cans

- Aluminium Cans

- Tin Cans

- Others

5.2. By Application

- Food & Beverage

- Automotive

- Healthcare

- Others

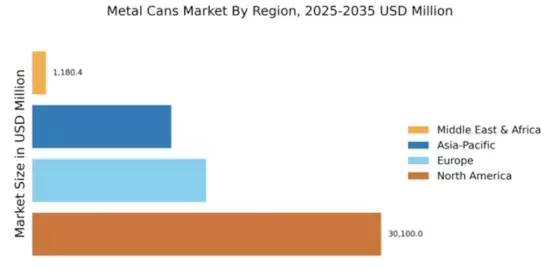

5.3. By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

6. Data Collection and Analysis

The data collected from primary and secondary sources is analyzed using qualitative and quantitative methods. Both top-down and bottom-up approaches were adopted to draw an accurate conclusion. The gathered data is validated using triangulation methodologies. The market insights were finally compiled in the form of tables, graphs, and charts.

7. Conclusion

This research methodology is designed in order to provide an in-depth market analysis of the metal cans market. The research utilized both primary and secondary research methodologies to draw an accurate conclusion. The segmentation of the metal cans market is studied in detail with the help of market insights gathered from stakeholders, industry analysts, and other sources. The market insights gathered through the research process were then analyzed using qualitative and quantitative methods to accurately assess the competitive landscape of the metal cans market and draw effective conclusions.