Rising Prevalence of Mendelian Disorders

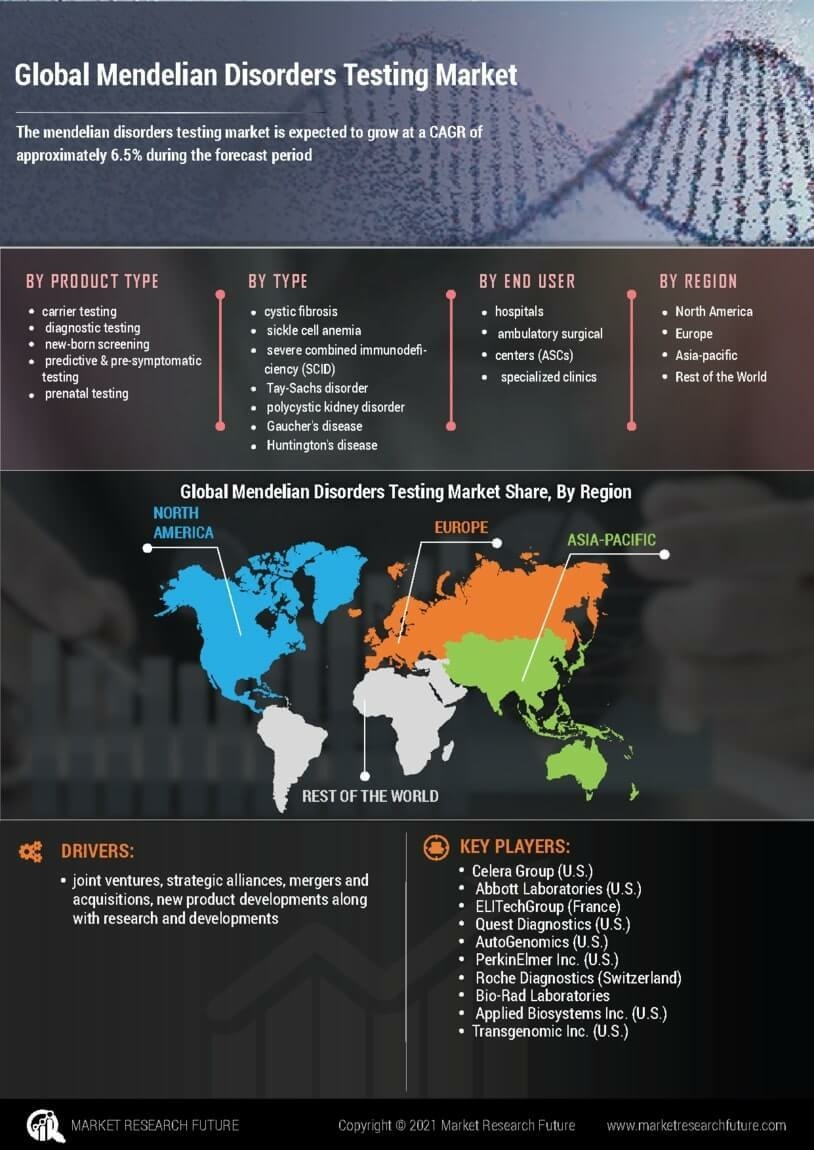

The increasing prevalence of Mendelian disorders is a critical factor driving the Mendelian Disorders Testing Market. Conditions such as cystic fibrosis, sickle cell disease, and Huntington's disease are becoming more recognized, leading to a greater need for effective diagnostic solutions. Epidemiological studies indicate that approximately 1 in 200 individuals are affected by a Mendelian disorder, underscoring the urgency for comprehensive testing options. As awareness of these conditions grows, so does the demand for genetic testing services that can provide accurate diagnoses and inform treatment decisions. This rising prevalence is likely to stimulate market growth, as healthcare systems strive to address the needs of affected populations.

Regulatory Developments and Standardization

The Mendelian Disorders Testing Market is influenced by evolving regulatory frameworks aimed at ensuring the safety and efficacy of genetic testing. Regulatory bodies are increasingly focusing on standardizing testing procedures and validating the accuracy of results. This is particularly crucial as the market expands, with numerous new testing services entering the landscape. Enhanced regulations not only foster consumer trust but also encourage innovation among testing providers. As a result, companies are investing in compliance and quality assurance measures, which may lead to improved testing outcomes. The establishment of clear guidelines is anticipated to facilitate market growth, as stakeholders navigate the complexities of genetic testing.

Technological Advancements in Genetic Testing

The Mendelian Disorders Testing Market is experiencing a transformative phase due to rapid technological advancements. Innovations such as next-generation sequencing (NGS) and CRISPR gene editing are revolutionizing the landscape of genetic testing. These technologies enable more accurate and efficient identification of genetic mutations associated with Mendelian disorders. For instance, NGS allows for the simultaneous analysis of multiple genes, significantly reducing the time and cost associated with traditional testing methods. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 12% over the next five years. This growth is driven by the increasing adoption of these advanced technologies in clinical settings, enhancing diagnostic capabilities and patient outcomes.

Increased Awareness and Demand for Genetic Testing

The rising awareness regarding genetic disorders and the benefits of early diagnosis is propelling the Mendelian Disorders Testing Market forward. Educational initiatives and advocacy from healthcare professionals have led to a heightened understanding of genetic testing among the public. This awareness is reflected in the increasing demand for testing services, as individuals seek proactive measures for health management. According to recent surveys, nearly 60% of individuals express interest in genetic testing for hereditary conditions. This trend is likely to continue, as more people recognize the importance of genetic information in making informed healthcare decisions. Consequently, the market is expected to expand, driven by this growing consumer demand.

Integration of Genetic Testing in Clinical Practice

The integration of Mendelian disorders testing into routine clinical practice is a significant driver for the Mendelian Disorders Testing Market. Healthcare providers are increasingly recognizing the value of genetic testing in diagnosing and managing hereditary conditions. This integration is supported by clinical guidelines recommending genetic testing for specific patient populations, thereby enhancing the overall quality of care. As healthcare systems adopt personalized medicine approaches, the demand for genetic testing is expected to rise. Furthermore, the collaboration between genetic testing laboratories and healthcare providers is likely to streamline the testing process, making it more accessible to patients. This trend is indicative of a broader shift towards precision medicine, which is anticipated to bolster market growth.