Rising Healthcare Expenditure

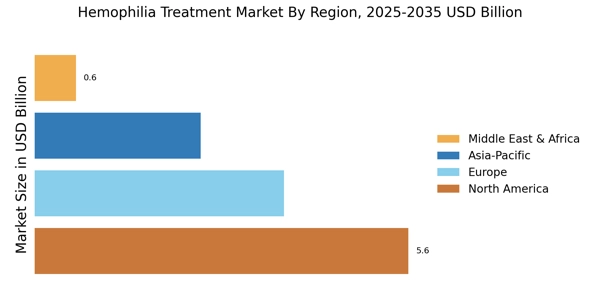

The increase in healthcare spending across various regions is a significant driver for the Hemophilia Treatment Market. As governments and private sectors allocate more resources to healthcare, the availability of funds for hemophilia treatments is expected to rise. This trend is particularly evident in developed economies, where healthcare budgets are expanding to accommodate advanced therapies and comprehensive care models. The focus on improving patient outcomes and quality of life is likely to lead to increased adoption of innovative treatment options. Consequently, this heightened investment in healthcare is anticipated to bolster the Hemophilia Treatment Market, facilitating access to essential therapies for patients.

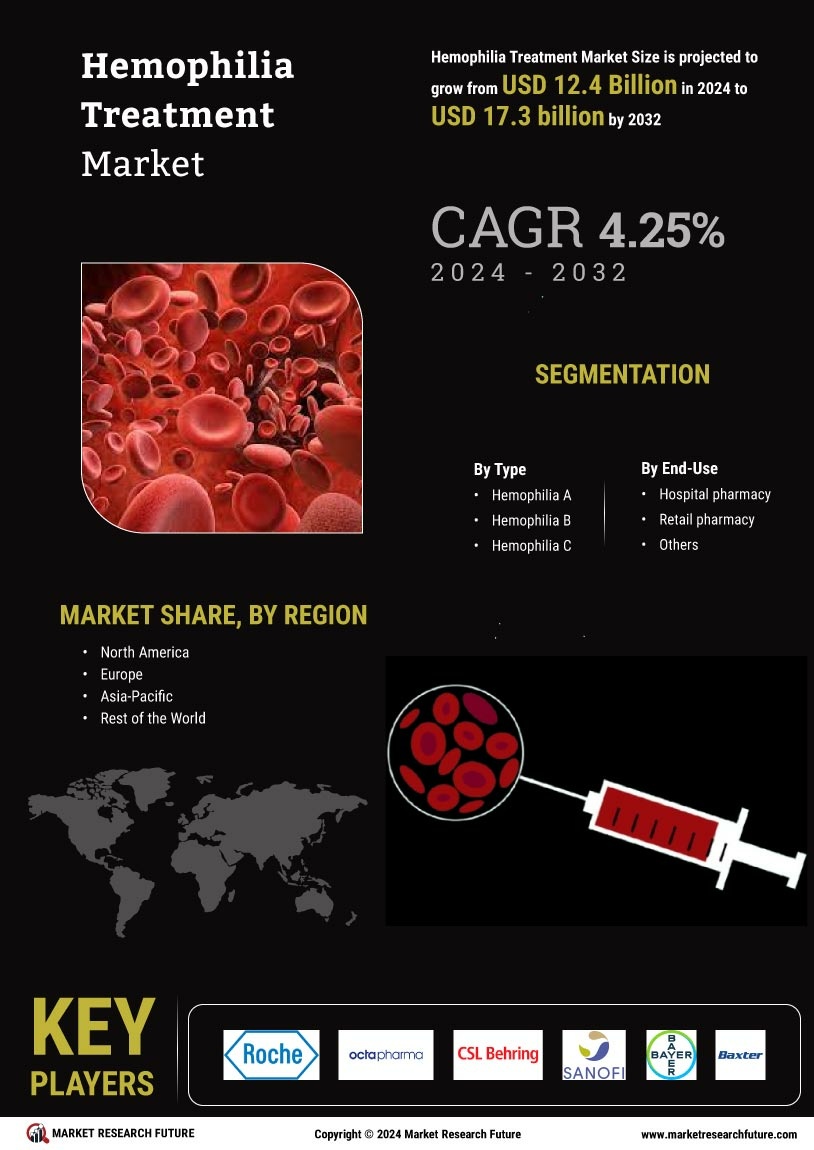

Increasing Prevalence of Hemophilia

The rising incidence of hemophilia is a crucial driver for the Hemophilia Treatment Market. Recent estimates indicate that hemophilia affects approximately 1 in 5,000 male births, leading to a significant patient population requiring ongoing treatment. This increasing prevalence necessitates the development and availability of effective therapies, thereby propelling market growth. As awareness of hemophilia improves, more individuals are diagnosed, further expanding the market. The need for innovative treatment options, including factor replacement therapies and novel agents, is likely to intensify as the patient base grows. Consequently, pharmaceutical companies are investing in research and development to address this unmet need, which is expected to enhance the Hemophilia Treatment Market significantly.

Growing Awareness and Education Initiatives

The emphasis on awareness and education regarding hemophilia is a vital driver for the Hemophilia Treatment Market. Various organizations and healthcare providers are actively promoting knowledge about hemophilia, its symptoms, and available treatments. This increased awareness is crucial for early diagnosis and timely intervention, which can significantly improve patient outcomes. As more individuals become informed about hemophilia, the demand for effective treatment options is likely to rise. Furthermore, educational initiatives aimed at healthcare professionals are essential for ensuring that patients receive optimal care. This growing focus on education is expected to positively impact the Hemophilia Treatment Market by fostering a more informed patient population.

Regulatory Support for Innovative Therapies

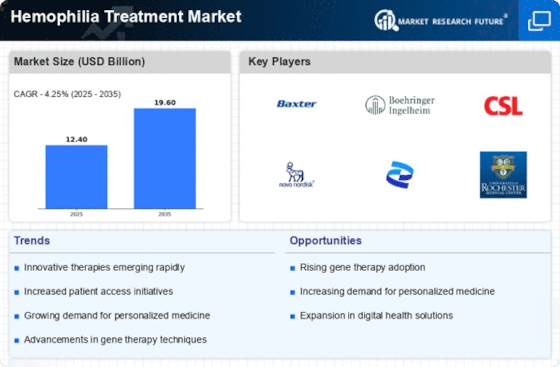

Regulatory bodies are increasingly supportive of innovative therapies in the Hemophilia Treatment Market, which serves as a key driver for market growth. Initiatives aimed at expediting the approval process for novel treatments, such as gene therapies and biosimilars, are becoming more prevalent. This regulatory environment encourages pharmaceutical companies to invest in research and development, leading to a broader array of treatment options for patients. The potential for faster access to groundbreaking therapies not only benefits patients but also stimulates competition among manufacturers. As a result, this supportive regulatory landscape is likely to enhance the Hemophilia Treatment Market, fostering innovation and improving patient care.

Technological Advancements in Treatment Options

Technological innovations play a pivotal role in shaping the Hemophilia Treatment Market. The introduction of advanced therapies, such as extended half-life factor concentrates, has transformed treatment paradigms, allowing for less frequent dosing and improved patient compliance. Moreover, the development of gene therapy represents a groundbreaking advancement, offering the potential for long-term solutions to hemophilia. These innovations not only enhance treatment efficacy but also reduce the overall burden of care on healthcare systems. As these technologies continue to evolve, they are likely to attract investment and drive competition among key players in the market, thereby fostering growth within the Hemophilia Treatment Market.