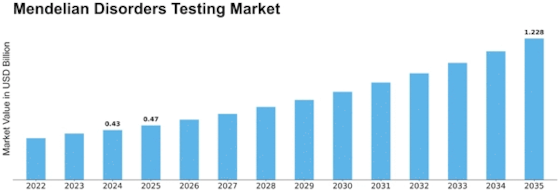

Mendelian Disorders Testing Size

Mendelian Disorders Testing Market Growth Projections and Opportunities

The Mendelian Disorders Testing Market, a crucial component of the healthcare industry, witnesses a dynamic interplay of market share positioning strategies among companies aiming to address the complex landscape of genetic disorders. One prevalent strategy is product differentiation, where companies focus on developing advanced genetic testing technologies or expanding their test portfolios to encompass a broader range of Mendelian disorders. By offering comprehensive and cutting-edge solutions, these companies aim to stand out in a competitive market, positioning themselves as leaders in providing accurate and reliable genetic testing for a diverse array of inherited conditions.

Cost leadership is another significant strategy in the Mendelian Disorders Testing Market. Given the importance of genetic testing in diagnosing and managing inherited disorders, companies strive to make their testing services more accessible by optimizing costs without compromising quality. Streamlining laboratory processes, adopting efficient technologies, and negotiating favorable partnerships with suppliers are common tactics to ensure cost-effective testing solutions. This approach enhances the affordability of genetic testing, appealing to a broader market and contributing to an expanded market share.

Market segmentation is a key aspect of strategic positioning in the Mendelian Disorders Testing Market. Companies recognize the diversity of Mendelian disorders and the unique genetic characteristics of different populations. Tailoring testing panels to address specific genetic variations prevalent in certain ethnic or geographic groups allows companies to provide targeted solutions. This targeted approach not only meets the specific needs of different patient populations but also helps in building a strong presence within niche markets.

Strategic collaborations and partnerships play a vital role in the Mendelian Disorders Testing Market. Companies often engage with research institutions, healthcare providers, and other industry stakeholders to enhance their understanding of genetic disorders, access valuable datasets, and accelerate the development of new testing methodologies. Collaborative efforts enable companies to stay at the forefront of genetic research, positioning themselves as leaders in innovation and reinforcing their market share.

Customer-centric strategies are paramount in the Mendelian Disorders Testing Market, given the sensitive nature of genetic testing. Companies that prioritize patient education, provide comprehensive genetic counseling services, and ensure clear communication of test results contribute to increased patient satisfaction and trust. Building strong relationships with healthcare providers and patients fosters loyalty and positively influences the market share of companies offering these essential genetic testing services.

Geographic expansion is a crucial element of market share positioning in the Mendelian Disorders Testing Market. Companies often target regions with a higher prevalence of specific genetic disorders or where there is a growing demand for advanced testing solutions. Establishing a robust presence in key markets allows companies to adapt their testing services to regional variations and preferences, contributing to an increased market share.

Leave a Comment