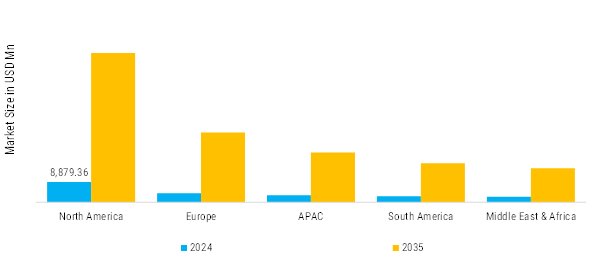

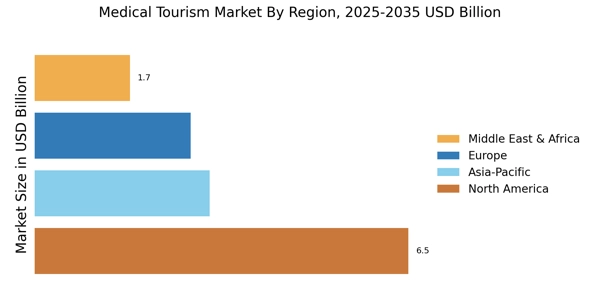

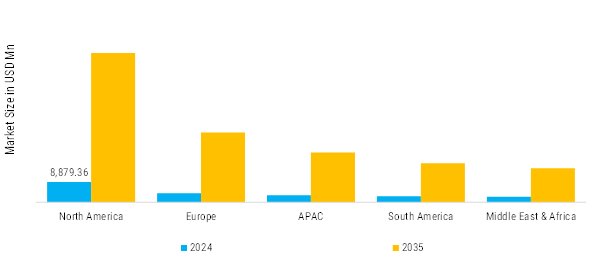

North America:

The North America medical tourism market accounted for USD 8,879.36 million in 2024 and is projected to grow at a CAGR of 16.06% during the forecast period. North America is further segmented into the US and Canada.

The North America medical tourism sector has shifted rapidly in responses to continuously high domestic healthcare costs, insurance gaps, and challenges to timely access. Mexico has emerged as a popular destination for Americans seeking lower-cost dental and cosmetic services, both to geographic proximity and government efforts to promote health travel. In contrast, the United States, despite being an appealing location for medical tourists, attracts inbound patients seeking highly specialized care in oncology, cardiology, and advanced surgeries, offered by world-class facilities. Anecdotal evidence suggests that a retired US couple flew to Thailand, Vietnam, Mexico, and the Caribbean for cancer treatment for a cost of USD 18,807, saving almost USD 100,000 compared to US prices and bypassing Medicare constraints. A US patient chose a USD 4,000 hysterectomy in Colombia over a USD 15,000 to USD 40,000 treatment in the US. They cited economical, high-quality care, full English assistance, and debt-free recovery. Despite these benefits, safety remains an important concern. Prior to the COVID-19 outbreak, some 400,000 Americans sought medical operations in Mexico each year.

Europe:

The Europe medical tourism market accounted for USD 7,733.00 million in 2024 and is projected to grow at a CAGR of 15.88% during the forecast period. Europe is further segmented into the Germany, France, UK, Russia, Italy, Spain, and Rest of the Europe.

Medical tourism has grown in prominence throughout Europe as patients seek more timely and cost-effective treatments in the midst of burdened home healthcare systems and long waiting lists. In the UK, post-COVID, the outflow began to accelerate. By 2022, around 350,000 UK residents traveled abroad for procedures (hip, knee replacements, cataracts, cardiology), up from around 248,000 in 2019, pushed mostly by overburdened NHS waiting times. Clinics in Lithuania, Poland, Croatia, and France are increasingly catering to these patients, providing faster access at reduced costs. A Highland patient's hip replacement in Poland, for instance, cost about half as much as private care in the UK.

The UK has seen an concerning surge in post-operative complications: NHS hospitals report that returning patients frequently have back superbug infections, leading to sepsis, chronic wounds, and, in some cases, death—complicating the NHS's ability to meet home care demand. Furthermore, aggressive social media advertising, like as Instagram ads for Brazilian butt lifts in Turkey, has generated ethical concerns, particularly after claims that at least 25 UK citizens have died following such procedures since 2019.

Asia-Pacific:

The Asia-Pacific medical tourism market accounted for USD 20,744.93 million in 2024 and is projected to grow at a CAGR of 19.31% during the forecast period. Asia-Pacific is further segmented into China, India, Japan, South Korea, Australia, and Rest of Asia-Pacific.

The Asia-Pacific medical tourism market has been strongly influenced by rising healthcare expenses in Western countries, the development of technologically advanced medical infrastructure throughout Asia, and increased consumer awareness of cross-border treatment choices. Since 2019, Thailand, India, Malaysia, and South Korea have attracted millions of patients each year seeking high-quality, low-cost medical operations ranging from cardiac surgery and orthopedics to cosmetic enhancements and fertility treatments. Thailand's combination of refined wellness with therapeutic services has made it a top destination, particularly for cosmetic and gender-affirming procedures. Malaysia, which had over 1.22 million medical tourists in 2019, has emerged as a destination for cardiology, fertility, cancer, and dental treatments, with specialized patient centers and regional offices. Thailand, a long-standing leader in the region, continues to draw international patients for cosmetic, wellness, and regenerative therapies, supported by world-class facilities and tourism integration.

India continues to draw a huge number of overseas patients from Africa, the Middle East, and South Asia due to its low cost, English-speaking doctors, and a reputation for expertise in cardiac treatment, oncology, and organ transplants. Despite disruptions during the pandemic, medical travel from nations including as Bangladesh, Iraq, Nigeria, and Kenya has steadily increased, according to India's Tourism Ministry. Moreover, according to the Ministry of Tourism, India registered 1,31,856 foreign visitor arrivals (FTAs) for medical purposes between January and April 2025, accounting for around 4.1% of overall FTAs during that time. The data was provided by the Union Minister of Tourism and Culture. To make things easier for international patients, the Government of India has extended e-medical visa and e-medical attendant visa capabilities to people of 171 countries. Furthermore, during the last five years, Bangladesh has emerged as the leading source country for medical tourists, with 4,82,336 arrivals expected in 2024, followed by Iraq (32,008), Somalia (11,717), Oman (10,431), and Uzbekistan (8,921). According to the Bureau of Immigration, the overall number of free trade agreements for medical purposes in 2024 was 6,44,387, up significantly from 1,82,945 in 2020.

Rest of the World:

The rest of the world medical tourism market accounted for USD 11,922.29 million in 2024 and is projected to grow at a CAGR of 18.21% during the forecast period. Rest of the World is further segmented into Middle East, Africa and South America. Africa is further segmented into Tunisia, Morocco, Kenya, Egypt, South Africa, and Rest of Africa.

The Rest of the World medical tourism market has seen significant transformation, owing to a combination of strategic infrastructure investments, government initiatives, and growing patient flows. In the Middle East, the United Arab Emirates, particularly Dubai and Abu Dhabi, have established themselves as a leading worldwide healthcare destination. In 2023, Dubai alone attracted roughly 691,000 medical tourists, who spent approximately AED 1 billion (nearly USD 280 million) on medical treatments. Its popularity arises from a seamless blend of high-end medical facilities, short treatment wait times, opulent recuperation alternatives, and integrated tourist, with platforms such as DXH offering one-stop access to consultations, accommodation, visas, and tourism packages.

The country is also pushing beyond the boundaries of technological integration: hospitals are investigating metaverse-assisted facility tours, and telehealth services are becoming more firmly integrated in the patient experience. Meanwhile, Turkey continues to lead the low-cost cosmetic and dental surgery market. In 2019, Turkey treated approximately 264,000 medical tourists in the first half of the year, with forecasts aiming for a million by the end of the year. By 2023, the number increased to 1.8 million visitors, creating around USD 3.1 billion in revenue. Turkey's medical tourism sector aims to reach USD 20 billion by 2028.

However, these gains are surpassed by safety concerns. Since 2019, at least 28 British patients have died following elective treatments in Turkey, sparking increased scrutiny and calls for more international oversight.

In Africa, countries such as Tunisia and South Africa are carving out a niche by combining economical, high-quality care with cultural and recreational activities. Tunisia receives approximately 500,000 foreign hospital patients each year, as well as two million same-day medical visitors, and offers services in fertility, cosmetic surgery, and unique treatments such as thalassotherapy employing Mediterranean minerals. South Africa, long a leader in the region, continues to draw patients for complicated treatments such as open-heart surgery and cosmetic improvements, often at a fraction of Western pricing, usually centered around centers like Cape Town.