Rising Focus on Preventive Healthcare

The Medical Electronics Market is increasingly influenced by a rising focus on preventive healthcare. As healthcare systems shift from reactive to proactive approaches, there is a growing emphasis on early detection and management of health conditions. This trend is reflected in the increasing adoption of wearable devices and health monitoring systems that empower individuals to take charge of their health. The preventive healthcare market is expected to grow at a CAGR of 7% over the next five years, indicating a robust shift in consumer behavior. Consequently, the Medical Electronics Market is likely to see a surge in demand for innovative technologies that support preventive measures, ultimately leading to improved health outcomes and reduced healthcare costs.

Advancements in Diagnostic Imaging Technologies

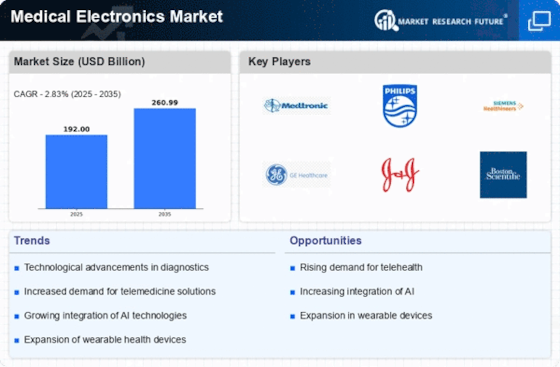

The Medical Electronics Market is witnessing rapid advancements in diagnostic imaging technologies, which are crucial for accurate disease detection and management. Innovations such as 3D imaging, MRI, and ultrasound technologies are becoming more sophisticated, enabling healthcare providers to obtain clearer and more detailed images. The Medical Electronics is expected to reach USD 45 billion by 2025, reflecting the increasing reliance on these technologies. Enhanced imaging capabilities not only improve diagnostic accuracy but also facilitate timely interventions, ultimately leading to better patient outcomes. Consequently, the Medical Electronics Market is likely to benefit from ongoing investments in research and development aimed at refining imaging technologies and expanding their applications.

Increasing Demand for Home Healthcare Solutions

The Medical Electronics Market is experiencing a notable surge in demand for home healthcare solutions. This trend is driven by an aging population and a growing preference for at-home medical care. According to recent data, the home healthcare market is projected to reach USD 300 billion by 2026, indicating a robust growth trajectory. Devices such as remote monitoring systems, portable diagnostic tools, and telehealth platforms are becoming increasingly prevalent. These innovations not only enhance patient comfort but also reduce the burden on healthcare facilities. As a result, the Medical Electronics Market is likely to see a significant uptick in the development and adoption of technologies that facilitate home-based care, thereby reshaping the landscape of healthcare delivery.

Regulatory Support for Medical Device Innovation

The Medical Electronics Market is benefiting from enhanced regulatory support aimed at fostering innovation in medical devices. Regulatory bodies are increasingly streamlining approval processes and providing incentives for the development of new technologies. This supportive environment encourages manufacturers to invest in research and development, leading to the introduction of cutting-edge medical devices. Recent initiatives have been launched to expedite the approval of breakthrough technologies, which could significantly impact the market landscape. As a result, the Medical Electronics Market is likely to experience accelerated growth, driven by a continuous influx of innovative products that meet evolving healthcare needs.

Integration of Internet of Things (IoT) in Medical Devices

The integration of Internet of Things (IoT) technology into medical devices is transforming the Medical Electronics Market. IoT-enabled devices allow for real-time data collection and monitoring, which enhances patient care and operational efficiency. The market for IoT in healthcare is projected to grow significantly, with estimates suggesting it could reach USD 100 billion by 2025. This integration facilitates remote patient monitoring, predictive analytics, and improved communication between patients and healthcare providers. As healthcare systems increasingly adopt IoT solutions, the Medical Electronics Market is poised for substantial growth, driven by the demand for smarter, more connected medical devices that enhance patient engagement and streamline healthcare processes.