Government Initiatives and Funding

The Medical Digital Imaging Devices Market is significantly influenced by government initiatives and funding aimed at enhancing healthcare infrastructure. Various governments are investing in healthcare modernization, which includes upgrading imaging facilities and expanding access to advanced imaging technologies. For example, initiatives to subsidize the purchase of digital imaging equipment are becoming more common, thereby encouraging healthcare providers to adopt state-of-the-art technologies. Additionally, public health campaigns that emphasize early detection and preventive care are further driving the need for advanced imaging solutions. As a result, the market is expected to benefit from increased public and private funding, which is projected to reach billions in the coming years, thereby fostering growth and innovation within the medical imaging sector.

Rising Demand for Diagnostic Imaging

The Medical Digital Imaging Devices Market is witnessing a surge in demand for diagnostic imaging services. This increase is driven by a growing prevalence of chronic diseases and an aging population that requires regular health assessments. As healthcare providers strive to offer timely and accurate diagnoses, the reliance on advanced imaging technologies becomes paramount. Recent statistics indicate that the demand for imaging services is expected to rise by 8% annually, reflecting the critical role that imaging plays in modern healthcare. Furthermore, the expansion of outpatient imaging centers and the increasing adoption of imaging modalities such as ultrasound and CT scans are contributing to this trend. This heightened demand underscores the necessity for continuous innovation and investment in the medical digital imaging sector.

Growing Focus on Preventive Healthcare

The Medical Digital Imaging Devices Market is increasingly aligned with the growing focus on preventive healthcare. As healthcare systems shift towards proactive management of health, the role of diagnostic imaging becomes more pronounced. Preventive healthcare strategies emphasize early detection of diseases, which is facilitated by advanced imaging technologies. This shift is reflected in the rising number of health screenings and routine imaging procedures being recommended by healthcare professionals. Data suggests that the preventive healthcare market is expanding at a rate of approximately 6% annually, which correlates with the increased utilization of medical imaging devices. This trend not only enhances patient care but also reduces long-term healthcare costs, making it a pivotal driver for the medical digital imaging market.

Technological Advancements in Imaging Techniques

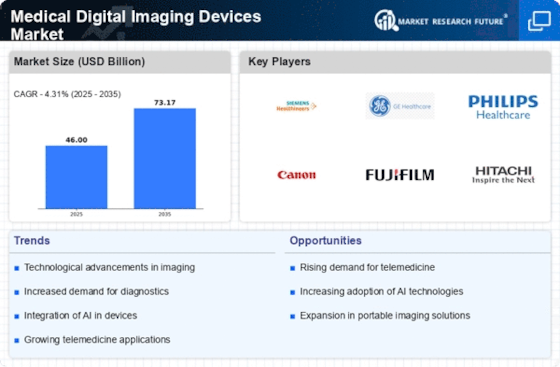

The Medical Digital Imaging Devices Market is experiencing rapid technological advancements that enhance imaging techniques. Innovations such as 3D imaging, high-resolution imaging, and portable imaging devices are becoming increasingly prevalent. These advancements not only improve diagnostic accuracy but also facilitate earlier detection of diseases. For instance, the introduction of digital X-rays and MRI machines with advanced software capabilities has led to a notable increase in the efficiency of imaging processes. According to recent data, the market for advanced imaging technologies is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years. This growth is indicative of the industry's commitment to integrating cutting-edge technology into medical imaging, thereby improving patient outcomes and operational efficiency.

Integration of Imaging with Electronic Health Records

The Medical Digital Imaging Devices Market is benefiting from the integration of imaging technologies with electronic health records (EHR). This integration streamlines workflows and enhances the accessibility of imaging data for healthcare providers. By allowing seamless sharing of imaging results within EHR systems, healthcare professionals can make more informed decisions regarding patient care. The trend towards interoperability is gaining momentum, with many healthcare institutions adopting integrated systems that facilitate real-time access to imaging data. Recent analyses indicate that the market for EHR-integrated imaging solutions is expected to grow by 9% over the next few years. This integration not only improves operational efficiency but also enhances patient safety and care quality, thereby driving growth in the medical digital imaging devices sector.