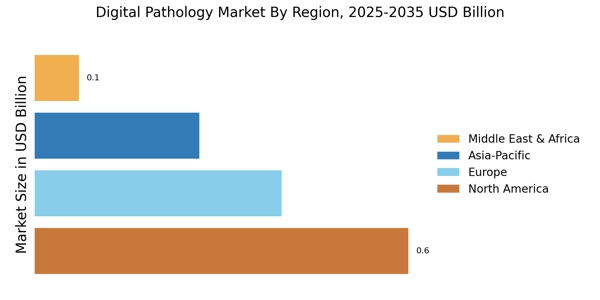

North America : Innovation and Leadership Hub

North America leads the digital pathology market, holding approximately 45% of the global share, driven by advanced healthcare infrastructure, increasing adoption of digital solutions, and supportive regulatory frameworks. The demand for efficient diagnostic tools and telepathology services is rising, fueled by the need for remote consultations and second opinions.

Regulatory bodies are actively promoting digital pathology to enhance diagnostic accuracy and patient outcomes. The United States is the largest market, followed by Canada, with key pathology software companies like Philips, Roche, and Ventana Medical Systems dominating the landscape. The competitive environment is characterized by continuous innovation and strategic partnerships among digital pathology companies. The presence of established firms and digital pathology startups alike fosters a dynamic market, ensuring a steady influx of advanced technologies and solutions.

Europe : Emerging Market with Growth Potential

Europe is witnessing significant growth in the digital pathology market, accounting for around 30% of the global share. The region benefits from stringent regulatory standards that encourage the adoption of digital solutions in healthcare. Countries like Germany and the UK are at the forefront, driven by investments in healthcare technology and a growing emphasis on personalized medicine.

The European Medicines Agency is actively working to streamline regulations for digital pathology, enhancing market accessibility. Germany leads the market, followed by the UK and France, with key players such as Leica Biosystems and Sectra making substantial contributions.

The competitive landscape is marked by collaborations between technology firms and healthcare providers, aiming to improve diagnostic workflows. The increasing focus on research and development in digital pathology solutions is expected to further propel market growth in the coming years.

Asia-Pacific : Rapidly Growing Market Segment

Asia-Pacific is rapidly emerging as a largest contributor to the Digital Pathology Market Size, holding approximately 20% of the global share. The region's growth is driven by increasing investments in healthcare infrastructure, rising awareness of digital solutions, and a growing aging population.

Countries like China and Japan are leading the charge, with government initiatives aimed at modernizing healthcare systems and improving diagnostic capabilities.

China is the largest market in the region, followed by Japan and Australia, with a mix of local and international players like 3DHISTECH and PathAI entering the market. The market share competitive landscape is evolving, with a focus on technological advancements and partnerships to enhance service delivery.

As healthcare providers increasingly adopt digital pathology solutions, the market is expected to witness robust growth in the coming years.

Middle East and Africa : Untapped Potential and Growth

The Middle East and Africa region is gradually emerging in the digital pathology market, currently holding about 5% of the global market share. The growth is primarily driven by increasing investments in healthcare infrastructure and a rising demand for advanced diagnostic solutions.

Countries like South Africa and the UAE are leading the way, with government initiatives aimed at enhancing healthcare services and adopting innovative technologies.

South Africa is the largest market in the region, followed by the UAE, with a growing presence of international players. The competitive landscape is characterized by collaborations between local healthcare providers and global technology firms, aiming to improve diagnostic accuracy and efficiency.

As awareness of digital pathology solutions increases, the market is poised for significant growth in the coming years.