Increasing Energy Demand in MEA

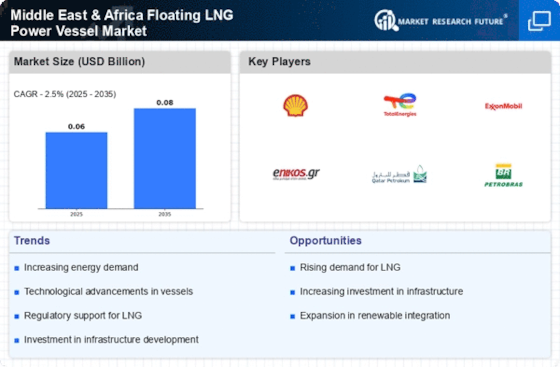

The MEA Floating LNG Power Vessel Market is experiencing a surge in energy demand, driven by rapid urbanization and industrial growth across the region. Countries such as Saudi Arabia and the UAE are investing heavily in infrastructure projects, which require substantial energy resources. The International Energy Agency projects that energy demand in the Middle East will increase by approximately 30% by 2040. This growing demand necessitates the adoption of flexible and efficient energy solutions, such as floating LNG power vessels, which can be deployed quickly and with lower capital costs compared to traditional power plants. As a result, the market for floating LNG power vessels is likely to expand significantly, providing a viable solution to meet the region's energy needs.

Strategic Geopolitical Positioning

The MEA Floating LNG Power Vessel Market benefits from the region's strategic geopolitical positioning, which facilitates access to global LNG supply chains. Countries like Qatar, one of the world's largest LNG exporters, play a crucial role in supplying LNG to various markets. The establishment of floating LNG power vessels allows MEA nations to leverage their geographical advantages, enabling them to import LNG efficiently and reduce dependency on traditional energy sources. This strategic positioning not only enhances energy security but also promotes regional cooperation in energy trade, potentially leading to increased investments in floating LNG technologies. As a result, the market is poised for growth, driven by the need for energy diversification and security.

Investment in Infrastructure Development

The MEA Floating LNG Power Vessel Market is significantly influenced by ongoing investments in infrastructure development across the region. Governments are prioritizing energy projects to support economic growth and sustainability goals. For instance, the UAE's Energy Strategy 2050 aims to increase the contribution of clean energy sources to 50% of the total energy mix. Floating LNG power vessels offer a flexible and scalable solution to meet these infrastructure demands, as they can be deployed in various locations without the need for extensive land-based facilities. This adaptability is particularly appealing in regions with challenging geographical conditions. Consequently, the influx of investments in floating LNG technologies is expected to drive market growth, as countries seek to enhance their energy infrastructure.

Technological Innovations in LNG Solutions

The MEA Floating LNG Power Vessel Market is witnessing a wave of technological innovations that enhance the efficiency and viability of floating LNG solutions. Advances in liquefaction technology, storage capabilities, and power generation systems are making floating LNG power vessels more competitive. For instance, the development of small-scale floating LNG facilities allows for greater flexibility in meeting localized energy demands. These innovations not only improve operational efficiency but also reduce costs associated with LNG transportation and storage. As technology continues to evolve, the market for floating LNG power vessels is expected to expand, driven by the need for innovative energy solutions that align with the MEA region's energy transition goals.

Environmental Regulations and Sustainability Goals

The MEA Floating LNG Power Vessel Market is increasingly shaped by stringent environmental regulations and sustainability goals set by governments in the region. As nations strive to reduce greenhouse gas emissions and transition to cleaner energy sources, floating LNG power vessels emerge as a viable alternative to traditional fossil fuel-based power generation. For example, the Saudi Vision 2030 emphasizes the importance of sustainable energy practices, which aligns with the adoption of LNG as a cleaner fuel option. The ability of floating LNG power vessels to provide cleaner energy solutions positions them favorably in the market, as they contribute to national and regional sustainability targets. This regulatory push is likely to accelerate the adoption of floating LNG technologies in the MEA region.