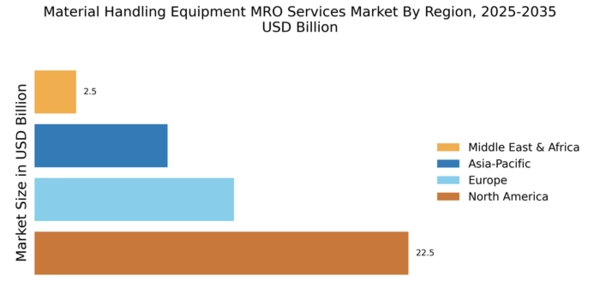

North America : Market Leader in MRO Services

North America is poised to maintain its leadership in the Material Handling Equipment MRO Services Market, holding a significant market share of 22.5% as of 2024. The region's growth is driven by increasing automation in warehouses and distribution centers, alongside stringent safety regulations that necessitate regular maintenance and servicing of equipment. The demand for advanced MRO services is further fueled by the rise in e-commerce, which requires efficient material handling solutions. The competitive landscape in North America is robust, featuring key players such as Caterpillar Inc, Hyster-Yale Materials Handling Inc, and Crown Equipment Corporation. These companies are investing heavily in innovative technologies and service offerings to enhance operational efficiency. The U.S. remains the largest market, supported by a strong manufacturing base and a focus on sustainability, which is driving the adoption of eco-friendly MRO practices.

Europe : Emerging Market Dynamics

Europe is witnessing a dynamic shift in the Material Handling Equipment MRO Services Market, with a market size of €12.0 billion. The region's growth is propelled by increasing investments in logistics and supply chain optimization, alongside regulatory frameworks that emphasize safety and efficiency. The European Union's initiatives to enhance industrial competitiveness are also contributing to the rising demand for MRO services, as companies seek to comply with stringent regulations and improve operational performance. Leading countries in this market include Germany, France, and the UK, where major players like Kion Group AG and Jungheinrich AG are actively expanding their service portfolios. The competitive landscape is characterized by a mix of established firms and emerging players, all vying for market share. The focus on digital transformation and automation in material handling is expected to further drive growth in the coming years.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region is emerging as a significant player in the Material Handling Equipment MRO Services Market, with a market size of $8.0 billion. The growth is primarily driven by rapid industrialization, urbanization, and the expansion of e-commerce platforms. Countries like China and India are witnessing a surge in demand for efficient material handling solutions, supported by government initiatives aimed at enhancing manufacturing capabilities and infrastructure development. China leads the market, with major companies such as Toyota Industries Corporation and Mitsubishi Logisnext Co Ltd investing in advanced MRO services. The competitive landscape is evolving, with both local and international players striving to capture market share. As the region continues to embrace automation and smart technologies, the demand for specialized MRO services is expected to rise significantly in the coming years.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa region is gradually developing its Material Handling Equipment MRO Services Market, currently valued at $2.5 billion. The growth is driven by increasing investments in infrastructure and logistics, particularly in countries like the UAE and South Africa. Government initiatives aimed at diversifying economies and enhancing trade are also contributing to the rising demand for MRO services, as businesses seek to optimize their operations and ensure compliance with safety regulations. In this region, the competitive landscape is still in its nascent stages, with a mix of local and international players entering the market. Companies are focusing on establishing service networks to cater to the growing demand. As the region continues to invest in modernization and technology, the MRO services market is expected to witness significant growth in the coming years.