Research Methodology on Material Handling Equipment Market

Abstract

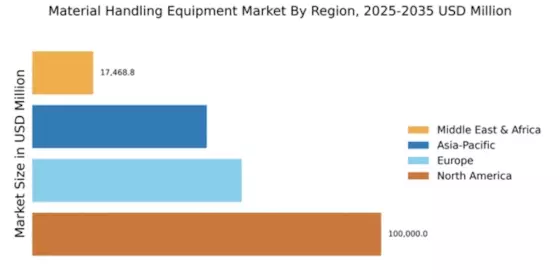

This research aims to review the Material Handling Equipment (MHE) market in terms of the global market, market structure, market share, market trends and potential growth opportunities, key players and their overall market contribution. The research report outlines the scope of the Material Handling Equipment market, its current market size and growth potential and projected growth rate, and recent market trends, including historical and current baseline data, growth rates and other related data.

Introduction

Material Handling equipment solutions enable efficient, safe and reliable movement of materials, goods, people and equipment. The need for MHE solutions is increasing in the production and distribution of goods, as well as in the shipping, loading, and unloading of goods. MHE solutions are used in various end-user industries including automotive, manufacturing, FMCG, healthcare, aerospace, and construction. One of the key factors driving the market for MHEs is the rising demand from production and distribution processes, where efficient and safe handling of goods helps minimise losses and injuries.

Research Methodology

The research for this report is conducted using a combination of both primary and secondary sources of information. Primary sources include interviews and surveys of industry experts, companies and other stakeholders. Interviews and surveys of industry experts focus on business models, drivers, constraints and trends in the MHE market. Secondary sources include books, industry reports, white papers, company websites, etc.

The research methodology used to collect and analyse data is comprehensive and consisted of four distinct steps: identification of key players, their product offerings, their market share and competitive landscape; analysis of industry trends and competitive landscape; customer needs assessment and customer segmentation; and finally, assessments of market size projections and competitive strategies.

Identifying the Key Players

The key players in the Material Handling Equipment (MHE) market are identified and evaluated based on their product offering, size, share, and competitive information. The key players evaluated are identified through primary and secondary sources. Primary sources include direct contact with manufacturers and smaller companies in the industry. Secondary sources include published articles, industry reports, white papers, books, and company websites.

Analysis of Industry Trends & Competitive Landscape

The next step involves studying the industry trends and competitive landscape to assess the prevailing conditions in the material handling equipment market. This step involves studying various aspects such as the macroeconomic environment, government policies, technological advancements, market drivers and restraints. The analysis of the competitive landscape is done by studying the current market share, industry players, and strategies.

Customer Needs Assessment & Segmentation

The next step in the methodology is to assess the customer needs and segmentation. This step involves understanding the different segments in the material handling equipment market. The customers are segmented based on the end-use industry and their requirements concerning product features, price, etc. The segmentation of the customers is done based on the analysis of the customer needs and is used to assess the potential of each segment in terms of growth rate and profitability.

Assessment of Market Size and Competitive Strategies

The last step in the research methodology is assessing the market size and competitive strategies. The market size is determined based on the current market size and projected growth rate. This is done by studying the historical market data, current market trends, and projected growth rate of the market. The assessment of the competitive strategies is done by studying the current strategies adopted by the various industry players and their product positioning.

Conclusion

The research methodology outlined in this report is comprehensive and allows for a thorough investigation of the Material Handling Equipment market. It enables a detailed assessment of the key players, their product offerings, market share, and competitive landscape. In addition, it also enables an assessment of customer needs, segmentation, and market size projections. Overall, this research methodology provides a comprehensive yet succinct approach to analyzing the market.