Regulatory Compliance and Quality Control

Regulatory compliance and quality control requirements are pivotal drivers of the Mass Spectrometry Software Market. Industries such as pharmaceuticals and biotechnology are subject to stringent regulations that necessitate accurate and reliable analytical results. Mass spectrometry software plays a crucial role in ensuring compliance with these regulations by providing robust data management and reporting capabilities. The need for quality assurance in product development and testing further propels the demand for mass spectrometry solutions. As organizations strive to meet regulatory standards, the Mass Spectrometry Software Market is likely to experience sustained growth, with software solutions becoming integral to quality control processes.

Technological Advancements in Mass Spectrometry

Technological advancements in mass spectrometry are significantly influencing the Mass Spectrometry Software Market. Innovations such as high-resolution mass spectrometry and improved data analysis algorithms enhance the capabilities of mass spectrometry software. These advancements enable researchers to analyze complex samples with greater sensitivity and specificity. Furthermore, the integration of machine learning and artificial intelligence into mass spectrometry software is expected to streamline data interpretation, making it more accessible for users. As a result, the Mass Spectrometry Software Market is poised for growth, with an increasing number of laboratories adopting these advanced technologies to improve their research outcomes and operational efficiency.

Increased Investment in Research and Development

Increased investment in research and development across various sectors is a significant driver of the Mass Spectrometry Software Market. As organizations allocate more resources to R&D, the demand for advanced analytical tools, including mass spectrometry software, rises. This trend is particularly evident in the pharmaceutical and biotechnology sectors, where the need for innovative drug development and testing methodologies is paramount. The Mass Spectrometry Software Market stands to benefit from this influx of investment, as researchers seek to leverage cutting-edge software solutions to enhance their analytical capabilities and accelerate the pace of discovery.

Rising Demand for Advanced Analytical Techniques

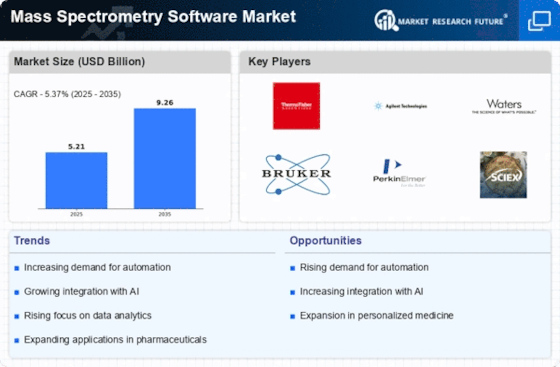

The increasing need for advanced analytical techniques in various sectors, including pharmaceuticals, environmental monitoring, and food safety, drives the Mass Spectrometry Software Market. As industries seek to enhance their analytical capabilities, the demand for sophisticated mass spectrometry software solutions rises. According to recent data, the market for mass spectrometry is projected to grow at a compound annual growth rate of approximately 8.5% over the next few years. This growth is attributed to the software's ability to provide precise and reliable results, which are essential for regulatory compliance and quality assurance. Consequently, the Mass Spectrometry Software Market is likely to witness a surge in demand as organizations prioritize accuracy and efficiency in their analytical processes.

Growing Applications in Proteomics and Metabolomics

The growing applications of mass spectrometry in proteomics and metabolomics are driving the Mass Spectrometry Software Market. As researchers increasingly utilize mass spectrometry for biomarker discovery and metabolic profiling, the demand for specialized software solutions rises. These applications require sophisticated data analysis tools to interpret complex datasets effectively. The expansion of personalized medicine initiatives further fuels this trend, as mass spectrometry plays a critical role in understanding disease mechanisms and developing targeted therapies. Consequently, the Mass Spectrometry Software Market is likely to see continued growth as the relevance of mass spectrometry in life sciences becomes more pronounced.