Regulatory Compliance and Emission Standards

The Marine Fuel Injection System Market is heavily shaped by stringent regulatory compliance and emission standards imposed by various maritime authorities. These regulations are designed to mitigate the environmental impact of marine vessels, compelling operators to adopt advanced fuel injection technologies that comply with these standards. The International Maritime Organization has set ambitious targets for reducing sulfur emissions, which has led to a surge in demand for fuel injection systems that can operate efficiently with low-sulfur fuels. Market analysis suggests that the compliance-driven demand for advanced fuel injection systems could increase by 25% over the next few years. This regulatory landscape is likely to drive innovation and investment in the Marine Fuel Injection System Market, as manufacturers strive to meet evolving standards.

Sustainability Initiatives in Marine Operations

The Marine Fuel Injection System Market is significantly influenced by the growing emphasis on sustainability within marine operations. As environmental concerns escalate, there is a marked shift towards adopting cleaner technologies that minimize the ecological footprint of maritime activities. The implementation of fuel injection systems that utilize alternative fuels, such as biofuels and LNG, is gaining traction. This shift not only aligns with global sustainability goals but also meets regulatory requirements aimed at reducing greenhouse gas emissions. Market data indicates that the demand for sustainable marine fuel solutions is expected to grow by 20% in the coming years. Consequently, the Marine Fuel Injection System Market is likely to see increased investment in systems that support these sustainable practices, thereby enhancing their market viability.

Rising Demand for High-Performance Marine Engines

The Marine Fuel Injection System Market is witnessing a rising demand for high-performance marine engines, which is directly influencing the adoption of advanced fuel injection systems. As the maritime industry seeks to enhance operational efficiency and reduce downtime, there is a growing preference for engines that deliver superior power and fuel economy. This trend is particularly evident in sectors such as commercial shipping and recreational boating, where performance is paramount. Recent market data indicates that the demand for high-performance marine engines is projected to grow by 18% in the next five years. Consequently, the Marine Fuel Injection System Market is likely to benefit from this trend, as manufacturers develop fuel injection systems that cater to the needs of high-performance applications.

Integration of Digital Technologies in Marine Fuel Systems

The Marine Fuel Injection System Market is increasingly integrating digital technologies to enhance operational efficiency and monitoring capabilities. The advent of IoT and data analytics is transforming how fuel injection systems are managed and optimized. These technologies enable real-time monitoring of fuel consumption and engine performance, allowing for predictive maintenance and improved decision-making. Market Research Future indicates that the adoption of digital solutions in marine fuel systems could increase by 30% over the next few years. This integration not only enhances the performance of marine fuel injection systems but also contributes to cost savings and operational efficiency. As a result, the Marine Fuel Injection System Market is likely to see a significant shift towards digitalization, which may redefine industry standards.

Technological Advancements in Marine Fuel Injection Systems

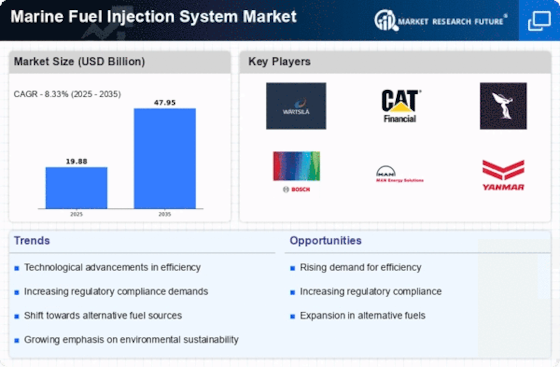

The Marine Fuel Injection System Market is experiencing a surge in technological advancements that enhance fuel efficiency and reduce emissions. Innovations such as common rail fuel injection systems and electronic control units are becoming increasingly prevalent. These technologies allow for precise fuel delivery, optimizing combustion processes and improving overall engine performance. According to recent data, the adoption of advanced fuel injection systems is projected to increase by approximately 15% over the next five years. This trend is driven by the need for compliance with stringent environmental regulations and the demand for higher efficiency in marine operations. As a result, manufacturers are investing heavily in research and development to create more sophisticated fuel injection solutions, which is likely to propel the Marine Fuel Injection System Market forward.