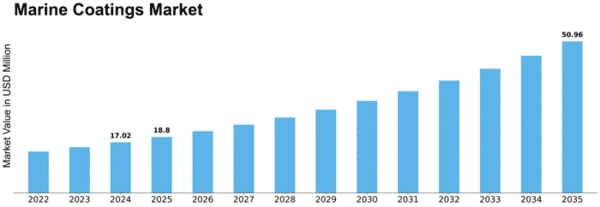

Marine Coatings Size

Marine coatings Market Growth Projections and Opportunities

Market Factors of Marine Coatings Market:

Shipping Industry Demand: The demand for marine coatings is heavily influenced by the shipping industry, which includes commercial shipping vessels, offshore rigs, and pleasure crafts. As the shipping industry grows, the need for protective coatings to prevent corrosion, fouling, and environmental damage on marine structures increases, driving market demand.

Regulatory Compliance: Compliance with international regulations such as the International Maritime Organization's (IMO) regulations on anti-fouling coatings and emissions control significantly impacts the marine coatings market. Regulations regarding VOC emissions, biocides, and hazardous substances drive manufacturers to develop environmentally friendly and compliant coating solutions, shaping market dynamics and product offerings.

Technological Innovations: Ongoing advancements in coating technologies and formulations contribute to market growth. Innovations in resin chemistry, nanoparticle additives, and application techniques improve coating performance, durability, and environmental sustainability, leading to the development of new marine coating products and applications.

Global Shipping Trends: Global shipping trends, including changes in trade patterns, vessel types, and fleet expansion, influence the demand for marine coatings. Increased maritime trade volumes, vessel refurbishments, and new shipbuilding activities drive market demand for protective coatings to maintain and enhance the lifespan of marine assets.

Environmental Concerns: Growing awareness of environmental sustainability drives the demand for eco-friendly marine coating solutions. Manufacturers are increasingly focusing on developing low-toxicity, biocide-free, and anti-fouling coatings to reduce environmental impact and meet regulatory requirements, influencing market trends and consumer preferences.

Market Competition: The marine coatings market is highly competitive, with key players competing based on factors such as product quality, performance, pricing, brand reputation, and service offerings. Market players invest in research and development to introduce new coating formulations, improve application techniques, and expand their product portfolios, driving market growth and enhancing competitiveness.

Corrosion Protection Needs: Corrosion protection is a primary driver for the marine coatings market, particularly for steel and metal structures exposed to harsh marine environments. Marine coatings provide essential corrosion resistance, preventing degradation and structural damage to ships, offshore platforms, piers, and bridges, thus driving market demand.

Maintenance and Repair Activities: Routine maintenance and repair activities in the marine industry require the application of protective coatings to extend the service life of marine assets. Coating inspection, refurbishment, and recoating are essential practices to maintain the integrity and performance of marine structures, driving ongoing demand for marine coatings.

Weathering Conditions: Weathering conditions such as UV radiation, saltwater exposure, temperature fluctuations, and atmospheric pollutants affect the performance and durability of marine coatings. Coatings with superior weathering resistance, UV protection, and anti-corrosive properties are in high demand to withstand harsh marine environments and prolong maintenance intervals.

Emerging Market Opportunities: Growth opportunities in emerging maritime markets, such as Asia-Pacific, Latin America, and Africa, present significant prospects for the marine coatings market. Rapid industrialization, infrastructure development, and increasing maritime trade activities drive the demand for protective coatings in these regions, fostering market growth and expansion.

Leave a Comment