Market Analysis

In-depth Analysis of Managed Pressure drilling Market Industry Landscape

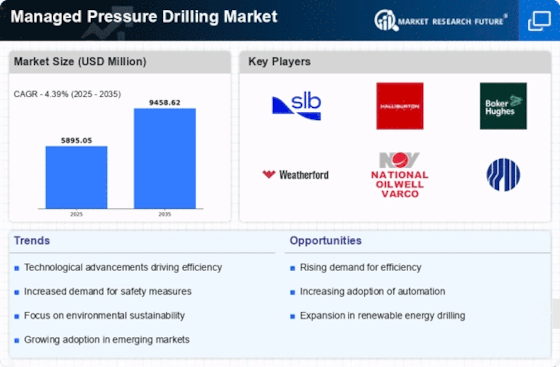

The managed pressure drilling market is set to reach US$ 4,523.7 MN by 2030, at a 3.90% CAGR between years 2022-2030. The market is undergoing profound changes in its dynamics with respect to the elements that influence the oil and gas industry. Overemphasis on effective pressure control has helped managed pressure drilling (MPD) to gain popularity since it can minimize the risks of drilling complications. Some of the notable market trends are technological innovations, rising offshore exploration activities and high demand for inexpensive as well as safer drilling solutions. Developments in technology have a significant implication on the market landscape of managed pressure drilling. The oil and gas industry is moving ahead in the use of novel drilling technologies as required all over. The emergence of superior sensors, quick data analysis and automation systems has made it possible for drillers to operate wellbore pressure properly thereby optimizing the rate parameters with a minimal risk of such incidents. This technological advance not only increases drilling productivity but also creates a conducive setting for the universal adoption of managed pressure systems. Another factor that contributes to building the market dynamics is offshore exploration activities. In offshore locations, drilling techniques have to be capable of accommodating different downhole conditions. In offshore drilling, managed pressure can be particularly valuable owing to the fact that it offers better control of wellbore pressure while minimising kick occurrence and improving safety measures. With the growth in offshore exploration activities, demand for managed pressure drilling services is projected to increase. This scenario will propel market dynamics towards more expansionary moves. The need for cost-efficient and safer methods of drilling is a primary market driving force in managed pressure drilling. The main disadvantages of traditional drilling include the greater expenses, longer time needed for operations and safety issues. These challenges are also dealt with through managed pressure drilling which is more effective and controlled means of drilling. MPD stands out as an appealing option for operators who wish to boost their drilling’s economics due to its capability of decreasing formation damage, optimizing fast-drill rates and the time nonproductive. With cost-efficiency and safety as primary concerns in the oil and gas industry, this development will naturally lead to market dynamics of managed pressure drilling driving further growth.

Leave a Comment