Increasing Oil Production Demand

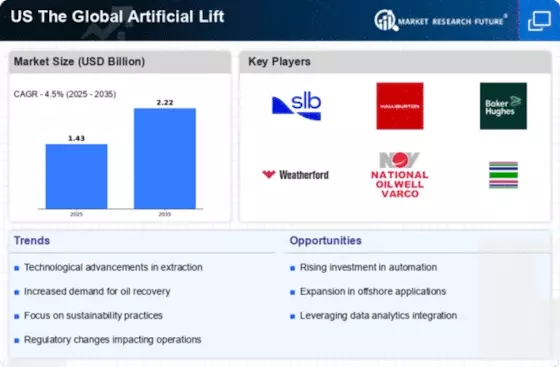

The US Artificial Lift Industry is experiencing a surge in demand for oil production, driven by the need to enhance recovery rates from existing wells. As domestic oil production continues to rise, the implementation of artificial lift systems becomes crucial for maintaining output levels. In 2025, the US produced approximately 12.5 million barrels per day, necessitating advanced technologies to optimize extraction processes. This trend indicates a growing reliance on artificial lift solutions, which are essential for maximizing the efficiency of oil recovery operations. The increasing focus on meeting both domestic and international energy demands further propels the market, as operators seek to leverage artificial lift technologies to sustain production levels and improve profitability.

Regulatory Support for Enhanced Recovery

The US Artificial Lift Industry benefits from regulatory frameworks that encourage enhanced oil recovery (EOR) techniques. Government policies aimed at promoting energy independence and reducing reliance on foreign oil have led to increased investments in artificial lift technologies. The US Department of Energy has initiated programs to support research and development in EOR methods, which often incorporate artificial lift systems. This regulatory support not only fosters innovation but also provides financial incentives for operators to adopt advanced technologies. As a result, the market is likely to witness growth as companies align their operations with government initiatives that prioritize sustainable and efficient oil extraction practices.

Rising Investment in Oil and Gas Infrastructure

The US Artificial Lift Industry is poised for growth due to rising investments in oil and gas infrastructure. As the US continues to expand its energy capabilities, significant capital is being allocated to enhance extraction and production facilities. In 2025, investments in upstream oil and gas infrastructure are projected to exceed USD 100 billion, creating opportunities for artificial lift technologies. This influx of capital is likely to drive demand for advanced artificial lift systems, as operators seek to optimize production and improve recovery rates. Furthermore, the expansion of pipeline networks and processing facilities will necessitate the integration of efficient artificial lift solutions, further solidifying the market's growth trajectory.

Focus on Sustainability and Environmental Impact

The US Artificial Lift Industry is increasingly shaped by a focus on sustainability and minimizing environmental impact. As public awareness of climate change grows, oil and gas companies are under pressure to adopt practices that reduce their carbon footprint. Artificial lift systems, particularly those that utilize renewable energy sources, are gaining traction as operators seek to align with sustainability goals. The integration of solar-powered pumps and other eco-friendly technologies is becoming more prevalent, reflecting a shift towards greener operations. This trend not only enhances the market's appeal but also positions companies favorably in a landscape that prioritizes environmental responsibility. The potential for reduced emissions and improved efficiency could lead to a more sustainable future for the artificial lift market.

Technological Innovations in Artificial Lift Systems

The US Artificial Lift Industry is significantly influenced by ongoing technological innovations in artificial lift systems. Advancements in materials, design, and automation have led to the development of more efficient and reliable lift solutions. For instance, the introduction of electric submersible pumps (ESPs) and progressive cavity pumps (PCPs) has revolutionized the way oil is extracted from wells. These technologies not only enhance production rates but also reduce operational costs, making them attractive to operators. In 2025, it is estimated that the market for ESPs alone will reach USD 2 billion, reflecting the growing adoption of these advanced systems. Such innovations are likely to drive competition and improve overall market dynamics.