Technological Innovations

Technological innovations play a crucial role in shaping the pressure pumping market. The advent of advanced technologies, such as real-time monitoring systems and automated pressure control, has significantly enhanced the efficiency and safety of pressure pumping operations. These innovations not only reduce operational costs but also improve the overall performance of hydraulic fracturing processes. For instance, the integration of data analytics and artificial intelligence in pressure pumping services allows for better decision-making and optimization of resources. As a result, companies are increasingly investing in research and development to stay competitive in the pressure pumping market. The ongoing evolution of technology is expected to drive further growth, as operators seek to maximize production while minimizing environmental impact.

Increasing Demand for Oil and Gas

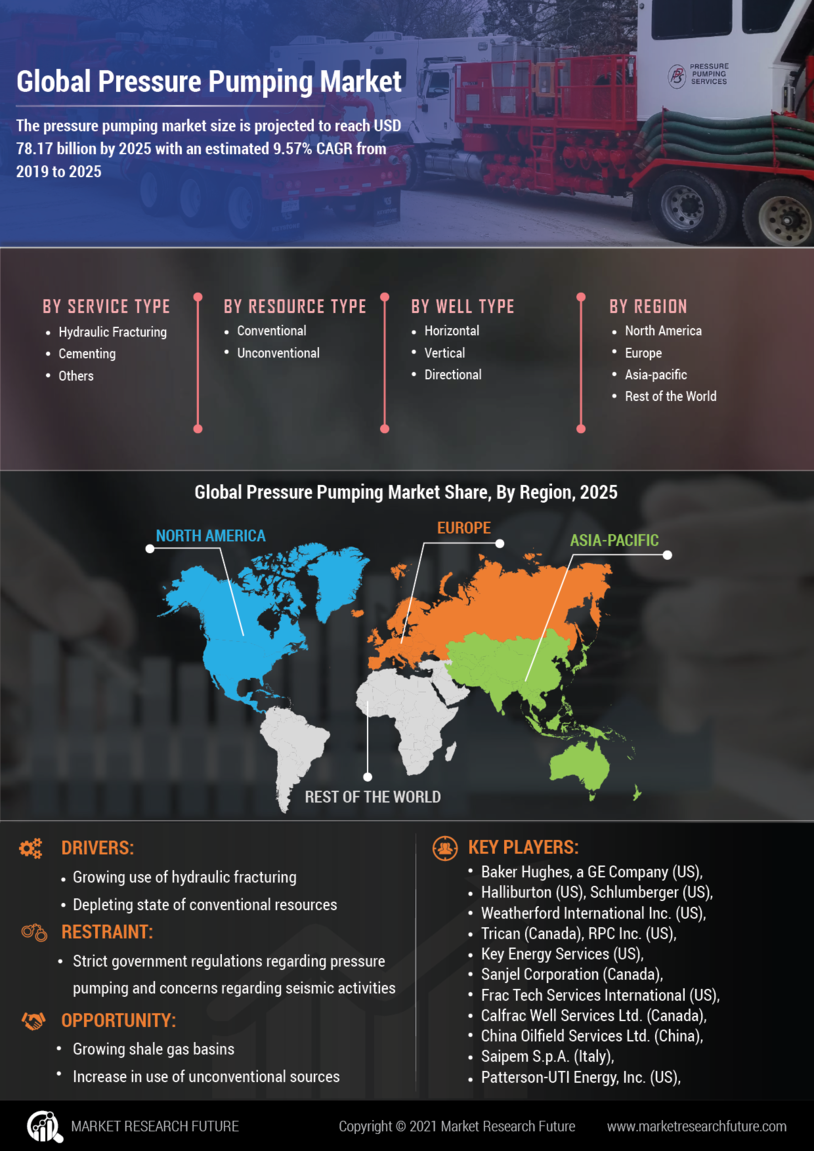

The pressure pumping market is experiencing a notable surge in demand for oil and gas, driven by the need for energy security and economic growth. As countries strive to meet their energy requirements, the exploration and production of unconventional resources, such as shale gas and tight oil, have become increasingly vital. This trend is reflected in the rising number of hydraulic fracturing operations, which utilize pressure pumping services to enhance extraction efficiency. According to recent data, the pressure pumping market is projected to grow at a compound annual growth rate of approximately 5% over the next few years, indicating a robust demand for these services. The increasing complexity of oil and gas reservoirs necessitates advanced pressure pumping techniques, further solidifying the industry's role in meeting global energy needs.

Rising Investment in Infrastructure

Investment in infrastructure development is a significant driver of the pressure pumping market. As countries expand their energy infrastructure to support growing populations and industrial activities, the demand for pressure pumping services is expected to rise. New pipelines, processing facilities, and storage systems require efficient extraction methods, which rely heavily on pressure pumping technologies. Recent reports indicate that infrastructure investment in the energy sector is projected to reach trillions of dollars over the next decade, creating substantial opportunities for pressure pumping service providers. This trend is particularly evident in regions with untapped resources, where the need for efficient extraction methods is paramount. The pressure pumping market stands to benefit from this influx of investment, as operators seek reliable and effective solutions to meet their energy demands.

Regulatory Environment and Compliance

The regulatory environment surrounding the pressure pumping market is becoming increasingly stringent, influencing operational practices and market dynamics. Governments are implementing stricter regulations to ensure environmental protection and safety in hydraulic fracturing activities. Compliance with these regulations often requires the adoption of advanced pressure pumping technologies and practices, which can lead to increased operational costs. However, this also presents an opportunity for companies that can innovate and adapt to these changes. The pressure pumping market is likely to see a shift towards more sustainable practices, as operators strive to meet regulatory requirements while maintaining profitability. This evolving landscape may drive consolidation among service providers, as smaller companies may struggle to comply with the new standards.

Focus on Enhanced Oil Recovery Techniques

The focus on enhanced oil recovery (EOR) techniques is becoming increasingly prominent within the pressure pumping market. As conventional oil reserves deplete, operators are turning to EOR methods to maximize extraction from existing fields. Pressure pumping services are integral to these techniques, as they facilitate the injection of fluids that help to mobilize trapped oil. The market for EOR is expected to grow significantly, with estimates suggesting that it could account for a substantial portion of global oil production in the coming years. This shift towards EOR not only enhances recovery rates but also extends the life of aging oil fields. Consequently, the pressure pumping market is likely to see increased demand for specialized services that cater to these advanced recovery methods.