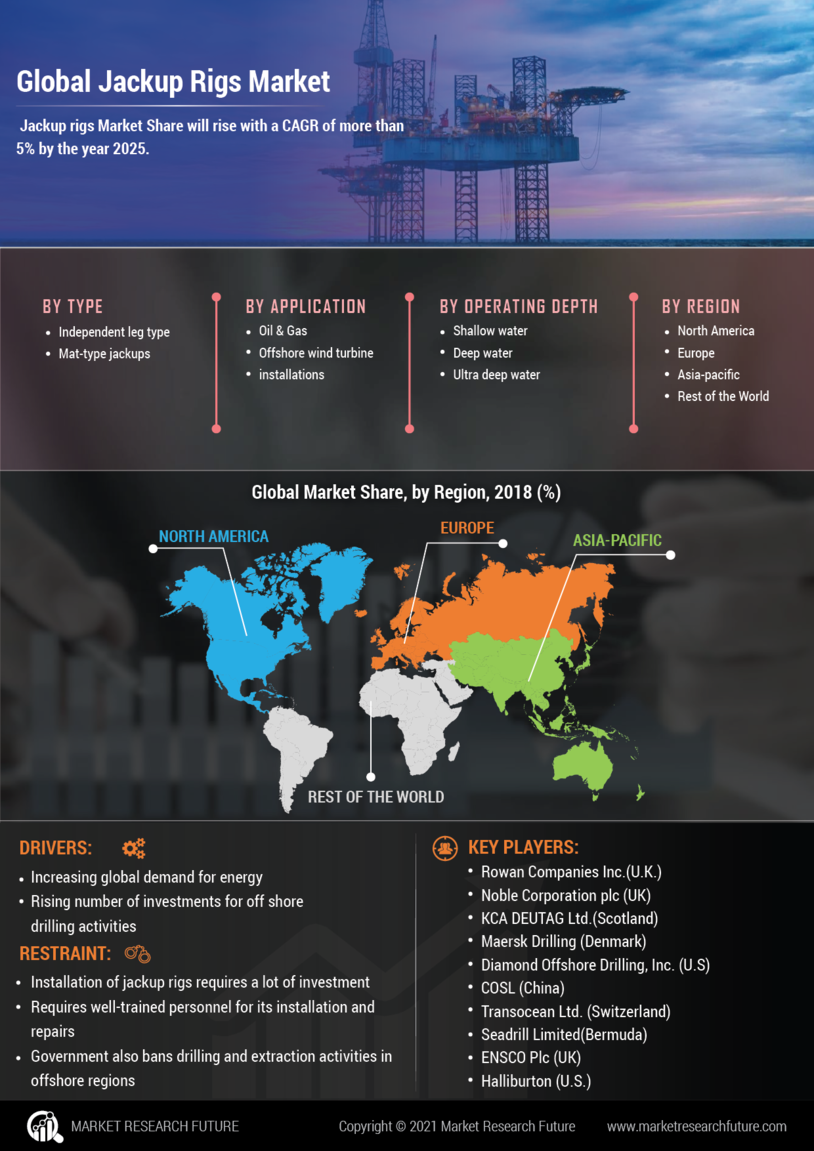

Rising Energy Demand

The Global Jackup Rigs Market Industry is experiencing a surge in demand driven by the increasing global energy requirements. As economies expand, the need for oil and gas escalates, particularly in emerging markets. This trend is underscored by projections indicating that the market will reach 124.1 USD Billion in 2024, reflecting a robust appetite for offshore drilling capabilities. The demand for jackup rigs is likely to be influenced by the necessity to explore untapped reserves, especially in regions where traditional drilling methods are becoming less viable. Consequently, the industry is poised for growth as operators seek to enhance their exploration and production activities.

Technological Advancements

Technological innovations play a pivotal role in shaping the Global Jackup Rigs Market Industry. Enhanced drilling technologies, including automated systems and advanced materials, are improving operational efficiency and safety. These advancements facilitate deeper and more complex drilling operations, thereby expanding the geographical reach of jackup rigs. As a result, operators are increasingly investing in modern rigs equipped with cutting-edge technology. This trend is expected to contribute to the market's growth, with forecasts suggesting a compound annual growth rate of 5.7% from 2025 to 2035. The integration of technology not only optimizes performance but also reduces operational costs, making it a key driver in the industry.

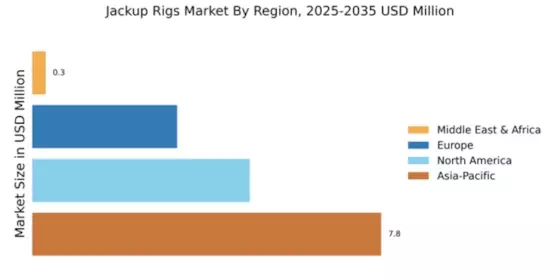

Market Diversification and Globalization

The Global Jackup Rigs Market Industry is witnessing diversification as companies expand their operations into new geographical regions. This globalization trend is driven by the search for new oil and gas reserves, particularly in regions such as Southeast Asia and West Africa. As companies venture into these markets, the demand for jackup rigs is expected to rise, reflecting the industry's adaptability to changing market dynamics. Moreover, the diversification of operations allows companies to mitigate risks associated with regional fluctuations in oil prices. This strategic approach not only enhances market resilience but also positions the industry for sustained growth in the coming years.

Increased Investment in Offshore Exploration

Investment in offshore exploration is a significant driver of the Global Jackup Rigs Market Industry. As oil prices stabilize, companies are reallocating resources towards offshore drilling projects, recognizing the potential of untapped reserves. This trend is evident in the projected market growth, with estimates indicating a rise to 228.4 USD Billion by 2035. The influx of capital into offshore exploration not only boosts demand for jackup rigs but also stimulates technological advancements and operational efficiencies. Furthermore, partnerships between oil companies and governments are likely to enhance exploration activities, creating a favorable environment for the jackup rig market to flourish.

Regulatory Support and Environmental Considerations

The Global Jackup Rigs Market Industry is influenced by regulatory frameworks that promote sustainable practices in offshore drilling. Governments worldwide are implementing stricter environmental regulations, which necessitate the adoption of cleaner technologies and practices. This regulatory support encourages investment in jackup rigs that comply with environmental standards, thereby fostering market growth. Additionally, the industry's commitment to reducing its carbon footprint aligns with global sustainability goals, making it a focal point for operators. As the market evolves, compliance with these regulations is likely to drive innovation and investment in more environmentally friendly rig designs, further enhancing the industry's prospects.