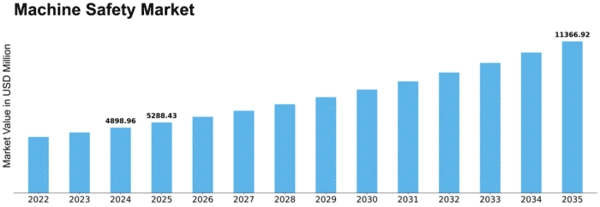

Machine Safety Size

Machine Safety Market Growth Projections and Opportunities

The Machine Safety Market, a crucial segment in the industrial landscape, is influenced by various market factors that shape its dynamics. One key determinant is the evolving regulatory landscape governing workplace safety. As governments and international organizations tighten regulations to ensure worker well-being, industries are compelled to invest in advanced machine safety solutions to comply with these standards. This trend has a cascading effect on the market, driving demand for safety components, systems, and services.

Technological advancements play a pivotal role in shaping the Machine Safety Market. The integration of cutting-edge technologies such as artificial intelligence, machine learning, and IoT in safety systems has enhanced the efficiency and effectiveness of machine safety solutions. This technological evolution not only addresses traditional safety concerns but also introduces predictive maintenance capabilities, reducing downtime and optimizing overall industrial operations. As industries embrace Industry 4.0 practices, the demand for smart and interconnected safety solutions is on the rise.

Market factors are also heavily influenced by the type of industries adopting machine safety measures. High-risk sectors such as manufacturing, construction, and energy have a more pronounced need for robust safety systems due to the inherently hazardous nature of their operations. The level of automation in these industries further accentuates the importance of machine safety, driving the market forward. Conversely, industries with lower safety risks may exhibit a more gradual adoption rate.

Global economic conditions significantly impact the Machine Safety Market. Economic downturns can lead to budget constraints for industries, affecting their capacity to invest in safety solutions. On the other hand, periods of economic growth often coincide with increased industrial activities, driving the demand for machine safety technologies. Market players must navigate these economic cycles and tailor their strategies accordingly to thrive in the dynamic landscape.

The competitive landscape and market consolidation also shape the trajectory of the Machine Safety Market. The presence of numerous players offering a diverse range of safety solutions creates a competitive environment. Mergers, acquisitions, and collaborations among key industry players influence market dynamics, leading to the emergence of integrated safety solutions and expanded product portfolios. This competition fosters innovation and drives the development of more advanced and cost-effective safety technologies.

Customer awareness and education are pivotal factors influencing the Machine Safety Market. As industries become more cognizant of the benefits of implementing robust safety measures, there is a growing willingness to invest in advanced safety solutions. Market players engage in educational initiatives to raise awareness about the importance of machine safety, creating a more informed customer base that actively seeks and adopts state-of-the-art safety technologies.

Leave a Comment