Research Methodology on Sugar Alcohol Market

Market Research Future (MRFR) has utilized a systematic approach, leveraging highly advanced and proven primary and secondary research tools and techniques to unearth true market insights and forecast future trends in the global Sugar Alcohol Market.

Primary Research:

Primary research comprises sources of primary data such as industry bodies, company publications and paid databases that are quality assured and reliable. Industry-wide conversations with experts, manufacturers, and key opinion leaders (KOLs) were undertaken to understand the global situation and subsequent market growth of the Sugar Alcohol Market. A telephonic interview was conducted covering different aspects such as planning, forecasting and other activities related to the market.

Secondary Research:

We collated and analyzed data from reliable sources such as SEC filings, industry trade journals and other in-depth market reports. We used white papers and news articles written by writers and industry veterans to understand the current trends and development in the Sugar Alcohol Market. Our team also undertook a thorough study of market segmentation, competitive landscape, KPIs, and prevailing industry standards.

Market size estimation:

The report outlines and provides the market size for the years 2023-2030. Both the top-down and bottom-up approaches have been considered to arrive at the market size estimates. Primary and secondary research sources have been referred to validate the market size estimations.

Market Segmentation:

The global sugar alcohol market is segmented into type, form, application, and region.

- By type, the market has been segmented into sorbitol, lactitol, erythritol, and others

- By form, the market is categorized into powder and syrup

- By application, the market has been divided into food & beverages, pharmaceuticals, and others

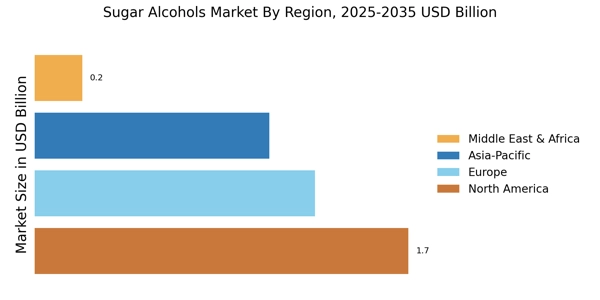

- By region, the market has been segmented into North America, Europe, Asia-Pacific, Latin America and the Middle East & Africa.

Analysis Period:

The analysis period has been considered to be 2023-2030.

Competitive Analysis:

Key players in the global sugar alcohol market have been identified and market dynamics such as drivers, restraints, and trends have been discussed. The report includes an analysis of key regions and countries, a market share analysis and Porter’s Five Forces analysis.

Primary Resources:

The report is compiled with trusted data and relevant metrics taken from companies and other concerned parties in the Sugar Alcohol Market. Interviews were conducted with industry experts in order to understand more deeply the details of the market and industry trends.

Secondary Resources:

- Company websites

- Investor presentations

- SEC filings

- Annual reports and financial statements

- Industry magazines

- White papers

- Paid databases

Data Modelling & Forecasting:

To arrive at accurate market trends and development in the Sugar Alcohol Market, the report employed both historical and current data points. Commissions study, interviews and industry survey data have been collected, validated and organised for the assessment of the global Sugar Alcohol Market. The forecast of market growth and development is based upon certain assumptions and key drivers. Passive methods like interviews with opinion leaders have been undertaken to validate the assumptions from both the demand and supply sides. The report used various types of data triangulation to arrive at actionable conclusions.

Data Profiling:

The data profiling segment of the report provides information related to market size and market size split in terms of value and volume. This data will be beneficial for investors, stakeholders, and new entrants in making the right decision to invest and succeed in the market. The data profiling has been done for types, forms, and applications across different regions.