E-commerce Growth

The rapid expansion of e-commerce is a pivotal driver for the Global Luxury Packaging Market Industry. As online shopping becomes increasingly popular, luxury brands are compelled to invest in packaging that ensures product safety during transit while also providing an unboxing experience that reflects their brand identity. This has led to the development of innovative packaging solutions that are both protective and aesthetically pleasing. The rise in online luxury sales is expected to contribute significantly to the market's growth, with projections indicating a market value of 11.6 USD Billion in 2024, as brands adapt to the evolving retail landscape.

Rising Disposable Income

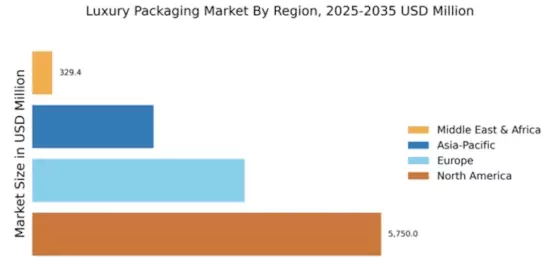

The Global Luxury Packaging Market Industry is significantly impacted by the rising disposable income of consumers, particularly in emerging economies. As individuals gain more financial freedom, their purchasing power increases, leading to a higher demand for luxury goods. This trend is particularly evident in regions such as Asia-Pacific, where a burgeoning middle class is driving luxury consumption. Consequently, brands are investing in premium packaging to enhance the perceived value of their products. This growing consumer base is expected to propel the market forward, contributing to a compound annual growth rate of 4.48% from 2025 to 2035.

Market Growth Projections

The Global Luxury Packaging Market Industry is projected to experience substantial growth over the coming years. With an anticipated market value of 11.6 USD Billion in 2024, the industry is poised for a robust expansion trajectory. By 2035, the market is expected to reach 18.8 USD Billion, reflecting a compound annual growth rate of 4.48% from 2025 to 2035. This growth is indicative of the increasing demand for luxury products and the corresponding need for high-quality packaging solutions that enhance product appeal and consumer engagement.

Sustainable Packaging Solutions

The Global Luxury Packaging Market Industry is increasingly influenced by the demand for sustainable packaging solutions. As consumers become more environmentally conscious, brands are adapting by utilizing biodegradable and recyclable materials. This shift not only caters to consumer preferences but also aligns with global sustainability goals. For instance, luxury brands are now opting for materials like recycled paper and plant-based plastics, which contribute to reducing carbon footprints. This trend is projected to drive the market's growth, as the industry is expected to reach 11.6 USD Billion in 2024, reflecting a significant shift towards eco-friendly practices.

Consumer Experience and Brand Loyalty

Enhancing consumer experience is a crucial driver within the Global Luxury Packaging Market Industry. Brands are recognizing that packaging plays a vital role in creating memorable experiences that foster brand loyalty. Luxurious packaging designs, personalized touches, and attention to detail are increasingly being prioritized to captivate consumers. For instance, brands are utilizing custom packaging solutions that reflect their unique identity, thereby enhancing customer satisfaction. This focus on consumer experience is likely to drive market growth, with expectations of reaching 18.8 USD Billion by 2035, as brands strive to differentiate themselves in a competitive landscape.

Technological Advancements in Packaging

Technological innovations are reshaping the Global Luxury Packaging Market Industry by enhancing product presentation and functionality. Advanced printing techniques, smart packaging, and augmented reality are becoming prevalent, allowing brands to create unique customer experiences. For example, luxury brands are employing QR codes and NFC technology to engage consumers through interactive packaging. These advancements not only improve aesthetics but also provide valuable information about the product. As the market evolves, the integration of technology is likely to contribute to a projected growth to 18.8 USD Billion by 2035, indicating a robust demand for innovative packaging solutions.