Market Analysis

In-depth Analysis of Low GWP Refrigerants Market Industry Landscape

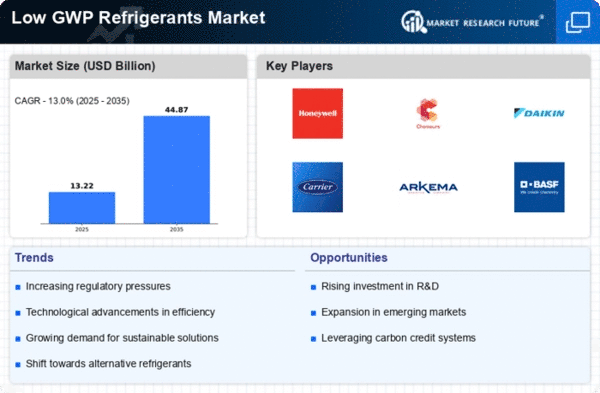

The market elements of low Global Warming Potential (GWP) refrigerants have gone through an extraordinary change lately, determined by a growing global familiarity with ecological worries and the need to relieve environmental change. Low GWP refrigerants, which reducedly affect the nursery impact contrasted with their high GWP partners, have turned into a point of convergence in the refrigeration and cooling industry. The interest for these harmless to the ecosystem choices has flooded as states overall sanction severe guidelines to deliberately get rid of high GWP refrigerants, lining up with global drives like the Kigali Alteration to the Montreal Convention.

One key driver affecting the low GWP refrigerants market is the rising accentuation on supportability and ecological obligation. Businesses and shoppers the same are perceiving the significance of embracing eco-accommodating refrigerants to limit the carbon impression related with cooling frameworks. This change in attitude has provoked makers to put vigorously in innovative work, expecting to figure out low GWP choices that consent to administrative norms as well as convey ideal execution.

Unofficial laws and strategies have arisen as powerful impetuses forming the low GWP refrigerants market scene. Nations and locales are carrying out severe rules to check the utilization of high GWP refrigerants, empowering the reception of low GWP choices. The European Association, for example, has been at the cutting edge of administrative drives with the F-Gas Guideline, which sets phasedown focuses for hydrofluorocarbon (HFC) refrigerants, pushing the business towards the reception of low GWP choices. Such administrative structures have constrained organizations to rethink their refrigerant options, cultivating a progress towards maintainable other options.

The monetary part of the low GWP refrigerants market can't be neglected. As the interest for these refrigerants keeps on rising, the economies of scale become possibly the most important factor, prompting cost decreases underway and dissemination. This cost-viability upgrades the engaging quality of low GWP refrigerants in the market, pursuing them a feasible and cutthroat decision for organizations hoping to line up with both natural and financial manageability objectives. The advancing market elements likewise animate advancement, empowering organizations to investigate new advancements and plans to remain ahead in the serious scene.

Mechanical progressions assume a vital part in forming the market elements of low GWP refrigerants. Scientists and specialists are continually endeavoring to foster refrigerants with unrivaled productivity, lower poisonousness, and negligible natural effect. Developments like regular refrigerants, hydrofluoroolefins (HFOs), and other low GWP choices are building up some momentum, offering a different scope of choices for different applications. The continuous quest for greener arrangements has prompted a powerful market climate, portrayed by a nonstop deluge of novel refrigerants intended to meet the developing requirements of various businesses.

Leave a Comment